FOREIGN TRADE

ZONE (FTZ)

Deferral

Are FTZs right for

your Supply Chain?

Are you importing goods from other countries?

If your business relies on imported products, an FTZ could provide valuable benefits.

Do you want to reduce or defer duties?

An FTZ allows you to defer duties until goods enter the domestic market—or even avoid them altogether for re-exported items.

Do you need storage in a transit country?

If your supply chain requires temporary storage before final delivery, an FTZ can facilitate this efficiently.

Do you require storage or a bonded carrier?

Your goods are for immediate distribution, storing them in an FTZ could add unnecessary costs. In some cases, a bonded carrier or customs-bonded warehouse might offer a simpler, more cost-effective alternative.

Can you consolidate shipments?

Would consolidating multiple smaller shipments with different delivery dates into one reduce clearance fees? Check if this is possible within your operations.

Does your product require re-work or handling?

If you import components from various suppliers for assembly, kitting, or packaging before distribution (e.g., assembling parts in the U.S. for export to Canada), an FTZ can support these activities while deferring duties.

Improve cash flow by

deferring duties with FTZs

Businesses across various industries leverage FTZs to optimize their supply chain processes. With an FTZ, a range of production and logistical activities can occur prior to the goods entering the domestic market and the payment of duties.

Find out if an FTZ is right for your business?

What customers are saying:

📢 listen to traffix on marketplace 📰

“companies seek tariff shelter in foreign trade zones”

TRAFFIX’ Director of Warehousing Solutions, Tim Huizinga, recently spoke with Sabri Ben-Achour of Marketplace about how Foreign Trade Zones (FTZs) can help importers navigate new tariffs while safeguarding their cash flow.

Read the full article here or catch the full show wherever you listen to podcasts.

Book your consultation!

Book Your Consultation

Defer or reduce duties with a custom FTZ solution –

Book your consultation!

"*" indicates required fields

why choose traffix?

Ready to Get your Custom FTZ Solution?

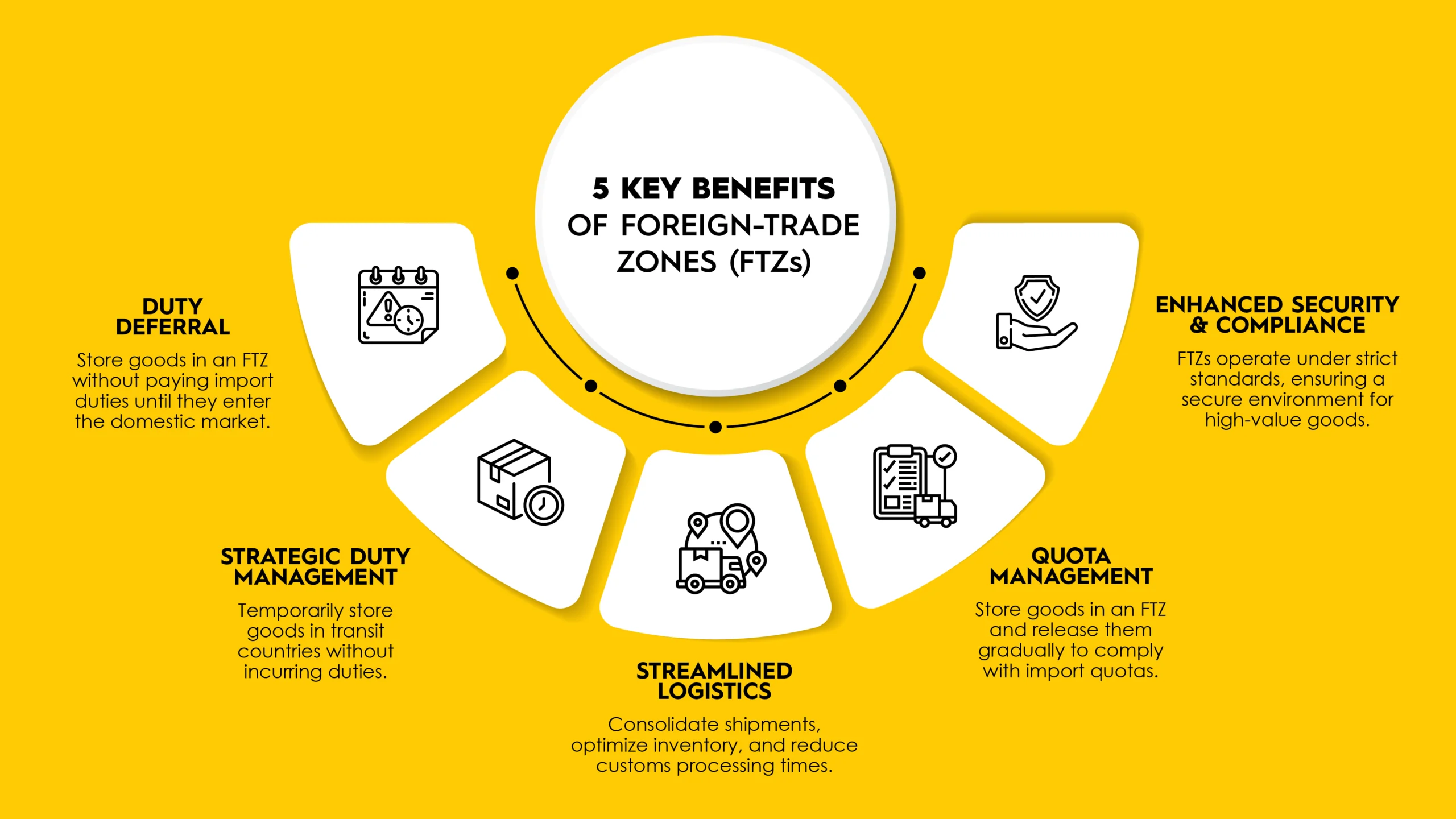

Foreign-Trade Zones present a strategic opportunity for businesses to enhance supply chain efficiency, reduce operational costs, and manage duties. Learn more ➡

Frequently Asked Questions

A Foreign-Trade Zone (FTZ) is a designated area within a country (this could be an industrial park, a single warehouse, a yard, etc.) that is treated as being outside the country’s customs territory for duty purposes. Goods stored or processed within an FTZ are not subject to customs duties until they are formally imported into the domestic market.

FTZs are often strategically located near ports of entry or major distribution hubs, allowing companies to streamline their supply chain with faster and simpler distribution of goods. Importers can defer payment of customs duties on items imported into an FTZ until the goods leave the zone to be transported domestically to the final destination, offering a strategic advantage in some supply chain operations.

Contact us today to learn more!

Any foreign or domestic merchandise not prohibited by law may be placed in a Foreign-Trade Zone (FTZ), whether dutiable or not. However, items that are illegal to import, subject to unlicensed regulation, or deemed harmful by federal agencies or the FTZ Board are prohibited. Quota-subject goods may be stored or manipulated in a zone but cannot be used to bypass import quotas. Book your consultation today!

Yes, Foreign-Trade Zones (FTZs) allow for a wide range of activities, including assembly, rework, repair, and repackaging. However, if your process involves substantial transformation or changes the customs classification of the product, it qualifies as “production activity” and must be specifically authorized by the FTZ Board. Note that retail trade is not permitted within FTZs.

Foreign-Trade Zones (FTZs) help companies reduce costs while enhancing supply chain efficiency and compliance. They offer several financial advantages, including:

-

No duties on imported goods that are re-exported

-

Delayed duty payments on goods entering the U.S. market

-

No duties on waste, scrap, or defective parts

-

Lower merchandise processing fees (MPFs)

-

Streamlined, more efficient supply chains

Award-Winning Service

TRAFFIX has earned numerous service awards, showcasing our commitment to excellence. Here are a few of our accolades.