TRAFFIX Trends Q1 2025

Published: January 16, 2025

Last Updated: January 4, 2026

key market indicators

Tariff Increases have the Potential to Dramatically Impact the Fright Market

The freight market in Q1 2025 is poised to be significantly influenced by potential tariffs from the incoming Trump administration.

Regardless of whether tariffs are enacted, the anticipation has led companies to increase import volumes, resulting in an amplified pre-Lunar New Year surge.

This surge is expected to sustain elevated freight rates through January and February. As inventories build up, a subsequent lull in rates may occur toward the end of Q1.

Transportation Price Increases are Expected to Accelerate

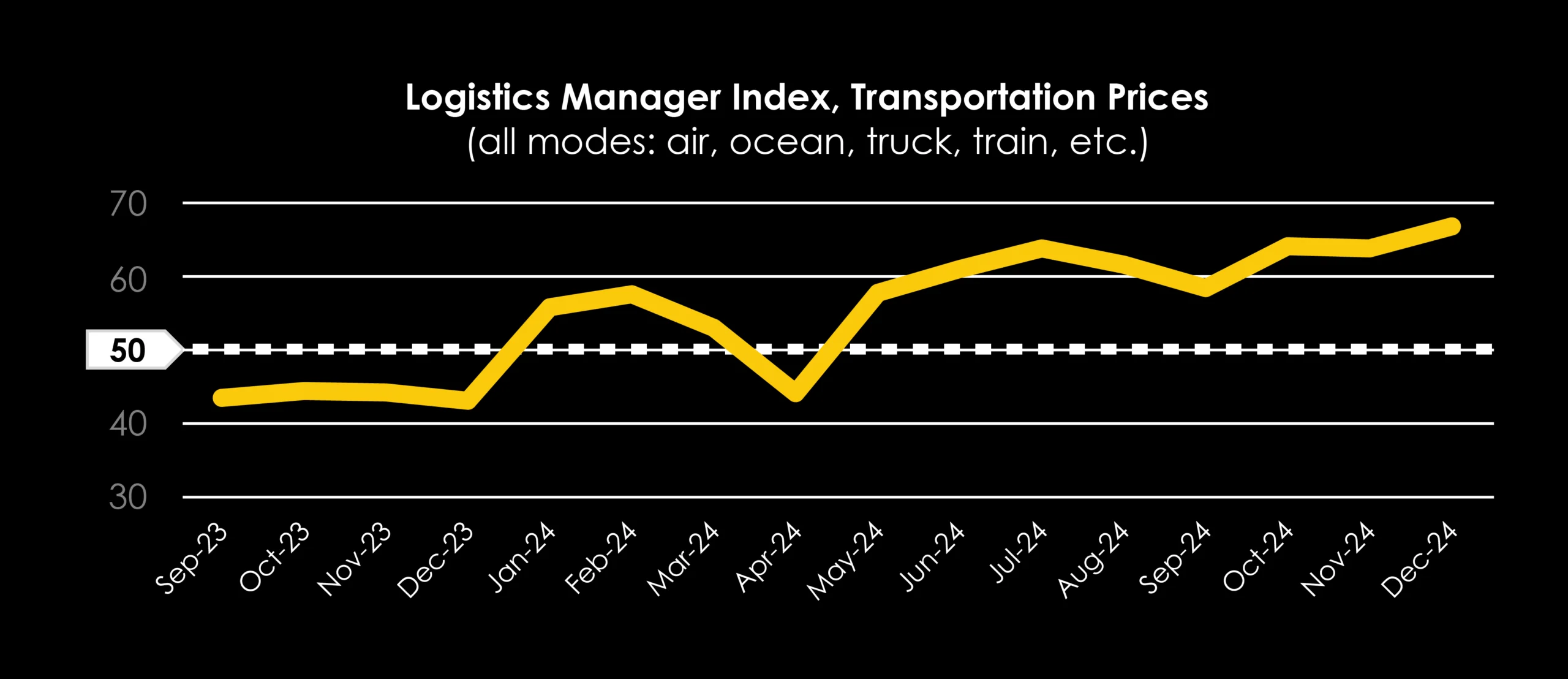

The Logistics Manager Index (LMI) of transportation prices has shown upward momentum for eight consecutive months. In addition, the LMI expectation for transportation prices over the next 12 months is 78 (where 50 is neutral), meaning there are strong expectations that prices will further increase over 2025.

Source: LMI

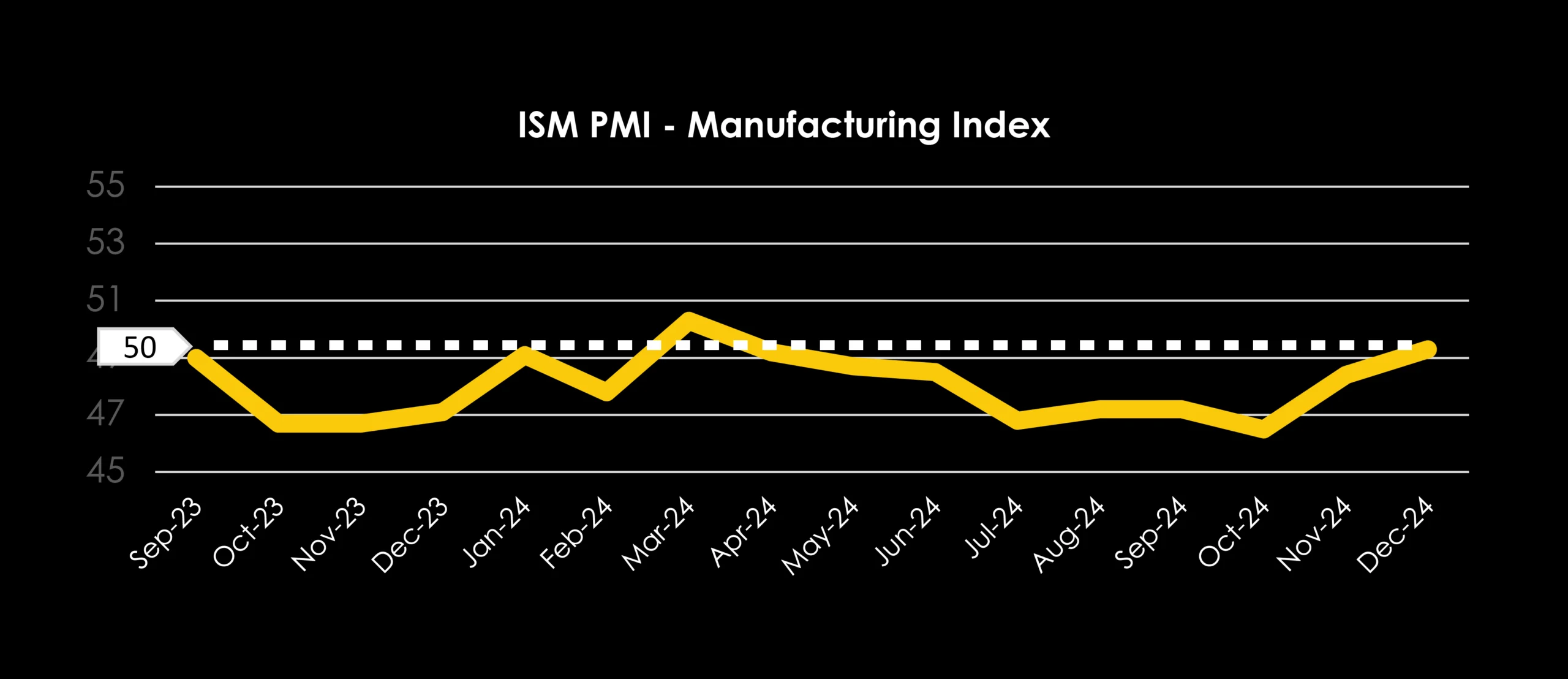

The Purchasing Manager’s Index (PMI) shows contraction slowing, inching back toward the neutral 50 mark. This indicates momentum for manufacturing to improve, with a return to expansion more likely in 2025. However, as shown in March 2024, we’ll need to see several consecutive months of expansion before concluding that a broad manufacturing recovery is taking place.

Source: PMI

US TRUCKING MARKET

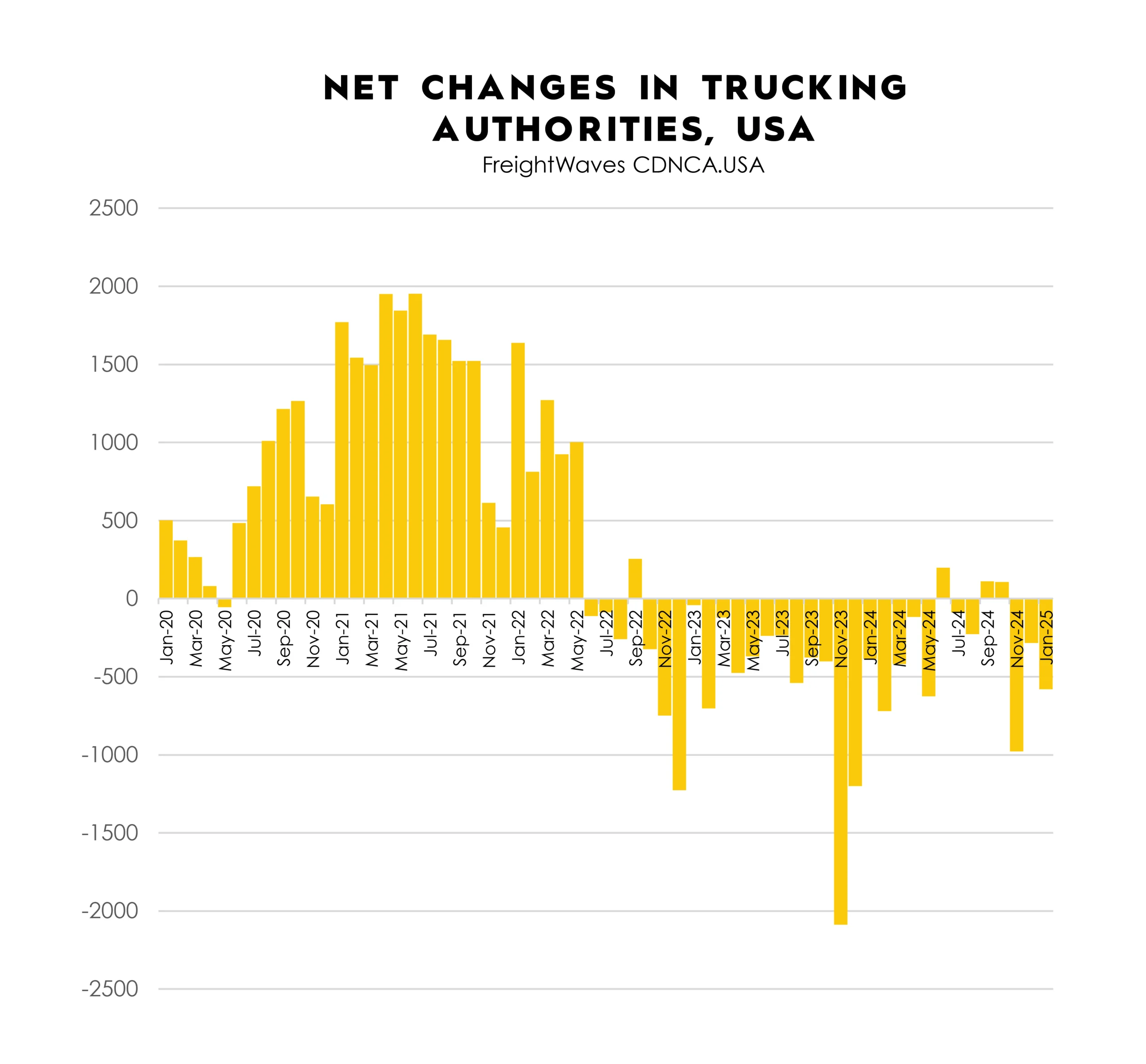

In recent years, the North American trucking market has experienced two major disruptions. The first was a demand surge driven by COVID-19, leading to skyrocketing demand for goods and elevated rates. This was followed by a supply influx, as high rates attracted new trucking companies into the market. As rates normalized and then declined, many trucking companies exited the market.

Since May 2022, there has been a net decrease of over 400 trucking authorities each month, totaling a reduction of more than 13,000. This contraction is gradually aligning trucking supply with demand, potentially leading to more volatile regional rates and, eventually, an overall rate increase.

Source: FreightWaves SONAR – January 7, 2025

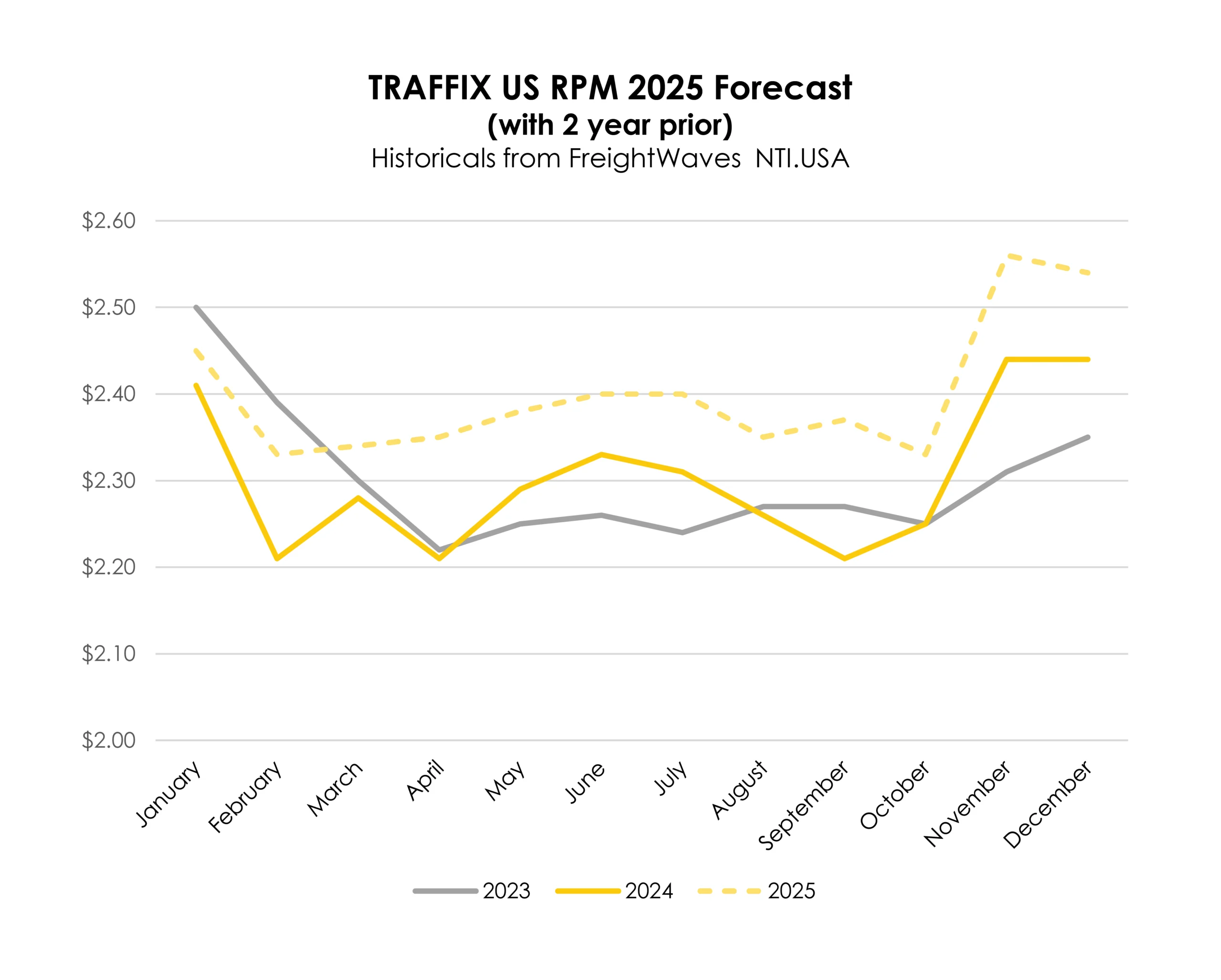

Without Major Market Disruptions, Gradual 4-6% Increase in Freight Rates Expected

- Oil futures suggest a relatively flat to decreasing trend for 2025, indicating a stable diesel market.

- Assuming fuel prices remain steady, we project a year-over-year rate increase of 4-6% from 2024.

- This modest rise is expected due to growing demand and a moderated supply, barring any major market disruptions.

Source: FreightWaves SONAR – January 7, 2025

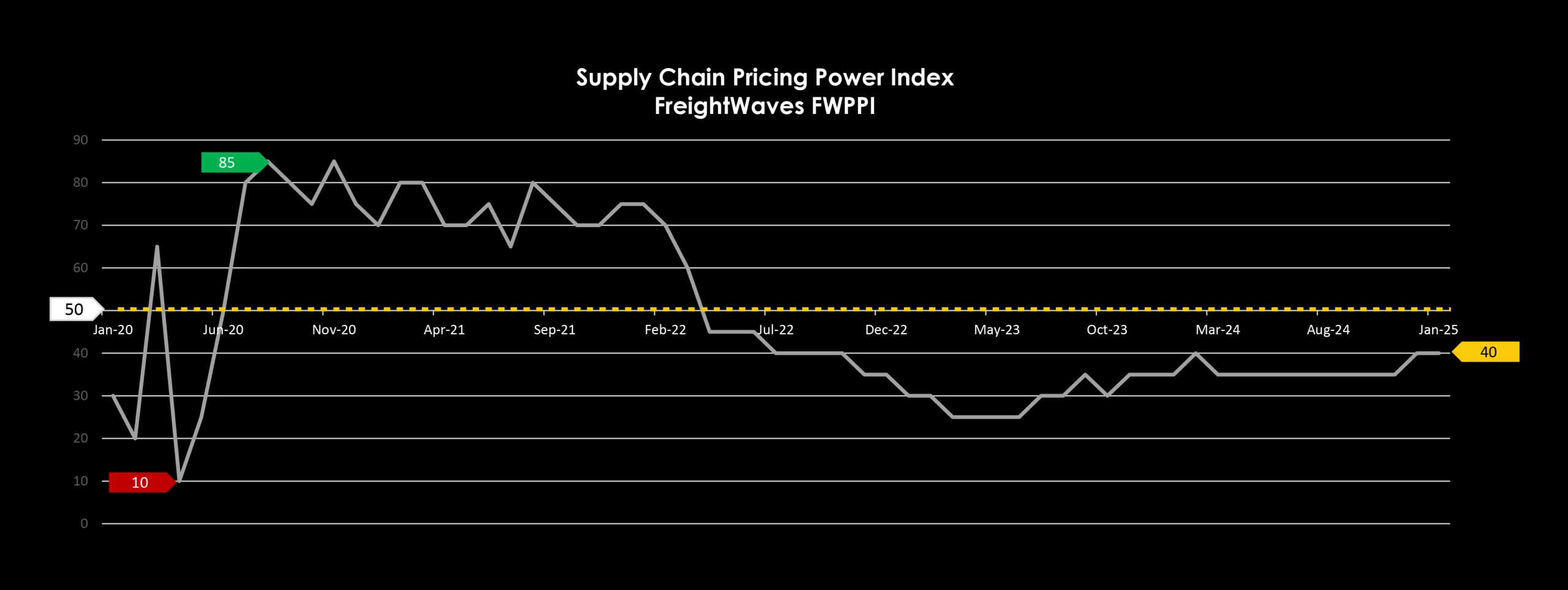

FREIGHT PRICING POWER INDEX

The past couple of years have favored shippers over carriers. According to the FreightWaves Supply Chain Pricing Power Index, values below 50 indicate a shipper’s market, while values above 50 signify a carrier’s market. At the end of 2024, the index rose from 35 to 40, indicating a shift toward a more balanced market. This trend is expected to continue, with shipper-carrier negotiations approaching equilibrium.

Source: FreightWaves SONAR – January 7, 2025

TRAFFIX FORECASTS: INSIGHTS & PREDICTIONS BY MODE

Anticipate moderate yet steady rate increases as demand aligns with supply. This segment remains susceptible to market disruptions.

LTL volumes are expected to increase 3-4%, and rates 5-7% in 2025. New freight classifications from the National Motor Freight Traffic Association (NMFTA) take effect on July 19, likely to result in rate changes and re-negotiations.

Expect modest rate increases as industrial production and construction rebound. Monitoring mortgage rates and construction permits will provide insights into demand.

Contracted rates down from peaks; spot will see volatility. Carriers are repositioning to the U.S. South, Texas, and California for produce season. Weather conditions will influence protect-from-freeze demand.

Network-wide capacity remains healthy with strong rail service. Volume no longer recessionary, 2-5% rate increases expected YOY

Drayage will be influenced by potential labor strikes, increased tariffs, and Lunar New Year impacts. Expect January General Rate Increases (GRIs) combined with frontloading by US shippers.

Canadian rates expected to rise modestly next 1-3 months. Political uncertainty is making forecasts unreliable. Expecting volatility until political situation calms. Western Canada, Arizona, California, Oregon and Washington will be the most heavily affected by the capacity issues until spring.

Mexico cross-border freight could be significantly impacted by any tariff increases between the US and Mexico. Aside from tariff impacts, expect rates to recede from peak season highs, but remain up year-over-year in the low single digits. Q1 produce season will impact Reefer demand and capacity.

Warehousing space available in all major markets, especially for temporary projects. Some locations filling up with pre-Lunar New Year stocks, but space still available.

7 LEADING INDICATORS TO WATCH IN Q1

1. Scope of tariffs instituted by the incoming Trump administration

2. Inflation and overall economic conditions

3. Diesel prices (oil prices fluctuations)

4. Consumer spending, particularly on durable goods

5. Global geopolitical tensions

6. Manufacturing activity (PMI)

7. Weather events

TRAFFIX FORECASTS: TRUCK FREIGHT GRADUAL

INCREASE TO +4-6 YOY OVER NEXT 12 MONTHS

- The freight market appears to be recovering from a prolonged period of depressed rates.

- The 2024 peak season mirrored pre-pandemic trends, exhibiting typical seasonality and surges.

- Capacity reductions have brought supply more in line with demand, exerting upward pressure on rates

- Anticipation of potential tariffs has already influenced rates, as companies expedite inventory ahead of the Lunar New Year to circumvent tariff impacts.

- The extent of additional tariffs will significantly affect the North American freight market

- If tariff increases are minimal, a moderate year-over-year rate rise of 4-6% is projected over the next 6-12 months.

- This baseline forecast is subject to change based on market disruptions and evolving trends in freight demand and supply

TRAFFIX Recommendations:

BUDGETING:

Structure transportation budgets and service expectations to accommodate a 4-6% year-over-year increase in trucking rates. Review contingency plans to prepare for potential market shocks stemming from tariffs and other external factors.

FREIGHT STRATEGY:

Reevaluate your approach to spot versus contract freight. Anticipate increased volatility in spot markets and consider whether shifting more freight to contract rates could mitigate variability.

CARRIER RELATIONS:

Engage with your carriers regarding expected rate increases and service expectations. Plan for gradual rate hikes of 4-6% over the next year. Reassess your strategy comprehensively once the implications of tariffs become clearer.

SUBSCRIBE TO TRAFFIX’

MARKET INSIGHTS

"*" indicates required fields