What are Foreign-Trade Zones and How can you Utilize Them in your Supply Chain?

Published: March 6, 2025

Last Updated: May 6, 2025

📢 listen to TRAFFIX on marketplace 📰

“companies seek tariff shelter in foreign trade zones”

TRAFFIX’ Director of Warehousing Solutions, Tim Huizinga, recently spoke with Sabri Ben-Achour of Marketplace about how Foreign Trade Zones (FTZs) can help importers navigate new tariffs while safeguarding their cash flow.

Read the full article here or catch the full show wherever you listen to podcasts.

As businesses navigate the intricacies of global supply chains, the pursuit of cost savings and operational efficiency becomes paramount. A Foreign-Trade Zone (FTZ) is one strategic tool that can help companies unlock these benefits. But what is an FTZ, and how can it transform your approach to international trade?

What is a Foreign-Trade Zone?

A Foreign-Trade Zone (FTZ) is a designated area within a country (this could be an industrial park, a single warehouse, a yard, etc.) that is treated as being outside the country’s customs territory for duty purposes. Goods stored or processed within an FTZ are not subject to customs duties until they are formally imported into the domestic market.

FTZs are often strategically located near ports of entry or major distribution hubs, allowing companies to streamline their supply chain with faster and simpler distribution of goods. Importers can defer payment of customs duties on items imported into an FTZ until the goods leave the zone to be transported domestically to the final destination, offering a strategic advantage in some supply chain operations.

How and why are FTZs used?

Businesses across various industries leverage FTZs to optimize their supply chain processes. Within an FTZ, a range of production and logistical activities can occur prior to the goods entering the market and payment of duties, including:

Assembling

Consolidating

Testing

Processing

Repackaging

Companies choose to utilize FTZs for several strategic reasons:

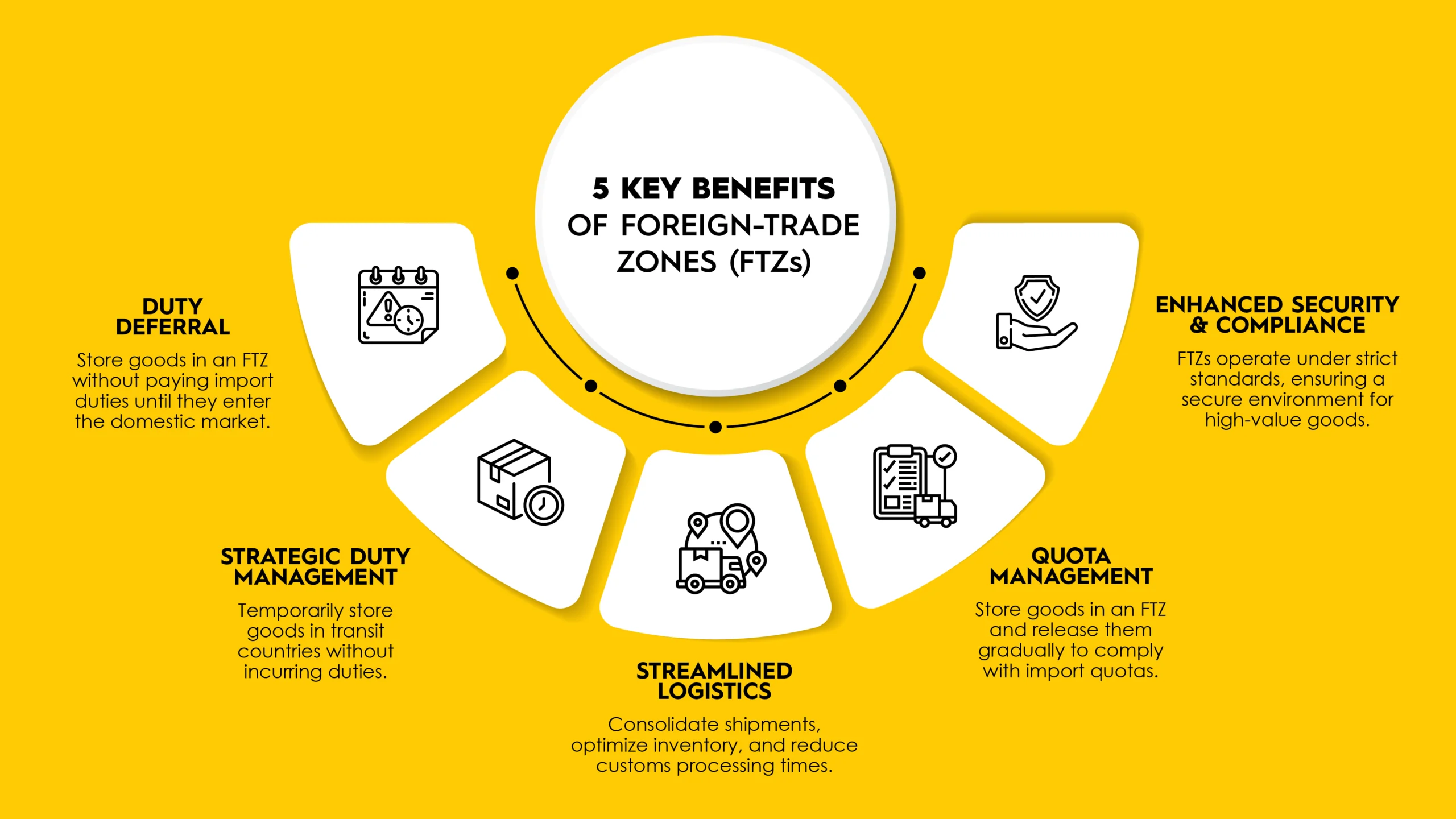

Duty Deferral: Goods can be stored in an FTZ without incurring import duties until they enter the domestic market, helping to improve cash flow by delaying duty payments.

Strategic Duty Management: Goods moving from one country (i.e., Mexico) through another country (i.e., the US) to their final destination (i.e., Canada) can be temporarily stored in an FTZ within the transit country without incurring duties there. This enables importers and exporters to strategically position their goods for optimized distribution while efficiently managing duties.

Streamlined logistics and inventory management: FTZs allow businesses to consolidate shipments/deliveries, optimize inventory storage and distribution, and simplify and reduce customs processing times, all of which can help save costs and optimize supply chain operations.

Quota management: Goods subject to import quotas can be stored in an FTZ until they are eligible for entry into the market. For example, if a business is restricted by a product import quota of 100 units per month, a business can import 1,000 units into an FTZ and gradually release them without breaching quota limits.

Enhanced security and compliance: FTZs operate under rigorous security and compliance standards, providing a secure environment for high-value goods and sensitive inventory.

Is an FTZ right for your business?

Determining whether an FTZ is the right solution for your business requires a thorough evaluation of your supply chain and financial goals. Consider the following questions to guide your decision-making process:

- Are you importing goods? If your business relies on imported products, an FTZ could provide valuable benefits.

- Do you want to defer or reduce duties? An FTZ allows you to defer duties until goods enter the domestic market—or even avoid them altogether for re-exported items.

- Do you need to store goods in a transit country? If your supply chain requires temporary storage before final delivery, an FTZ can facilitate this efficiently.

- Does your product require storage, or could you achieve the same result with a bonded carrier? If your goods are for immediate distribution, storing them in an FTZ could add unnecessary costs. In some cases, a bonded carrier or customs-bonded warehouse might offer a simpler, more cost-effective alternative.

- Can you consolidate shipments? Would consolidating multiple smaller shipments with different delivery dates into one reduce clearance fees? Check if this is possible within your operations.

- Does your product require re-work, handling, or assembly? If you import components from various suppliers for assembly, kitting, or packaging before distribution (e.g., assembling parts in the U.S. for export to Canada), an FTZ can support these activities while deferring duties.

Reviewing these factors can help you decide whether leveraging an FTZ aligns with your operational and financial objectives.

Final Thoughts

Foreign-Trade Zones present a strategic opportunity for businesses to enhance supply chain efficiency, reduce operational costs, and manage duties. By leveraging duty deferral, mitigating unnecessary tariffs, and optimizing storage and distribution, FTZs can be an integral part of a company’s strategy to optimize import/export operations and improve profitability.

Exploring the potential benefits of an FTZ could be a strategic step toward elevating your supply chain performance and achieving long-term success.

Ready to optimize your supply chain?

Article by Tim Huizinga, Director of Warehousing Solutions