TRAFFIX Trends Q1 2026

January 13, 2026

KEY MARKET INDICATORS

Demand remains soft, but shrinking capacity has made the market increasingly reactive

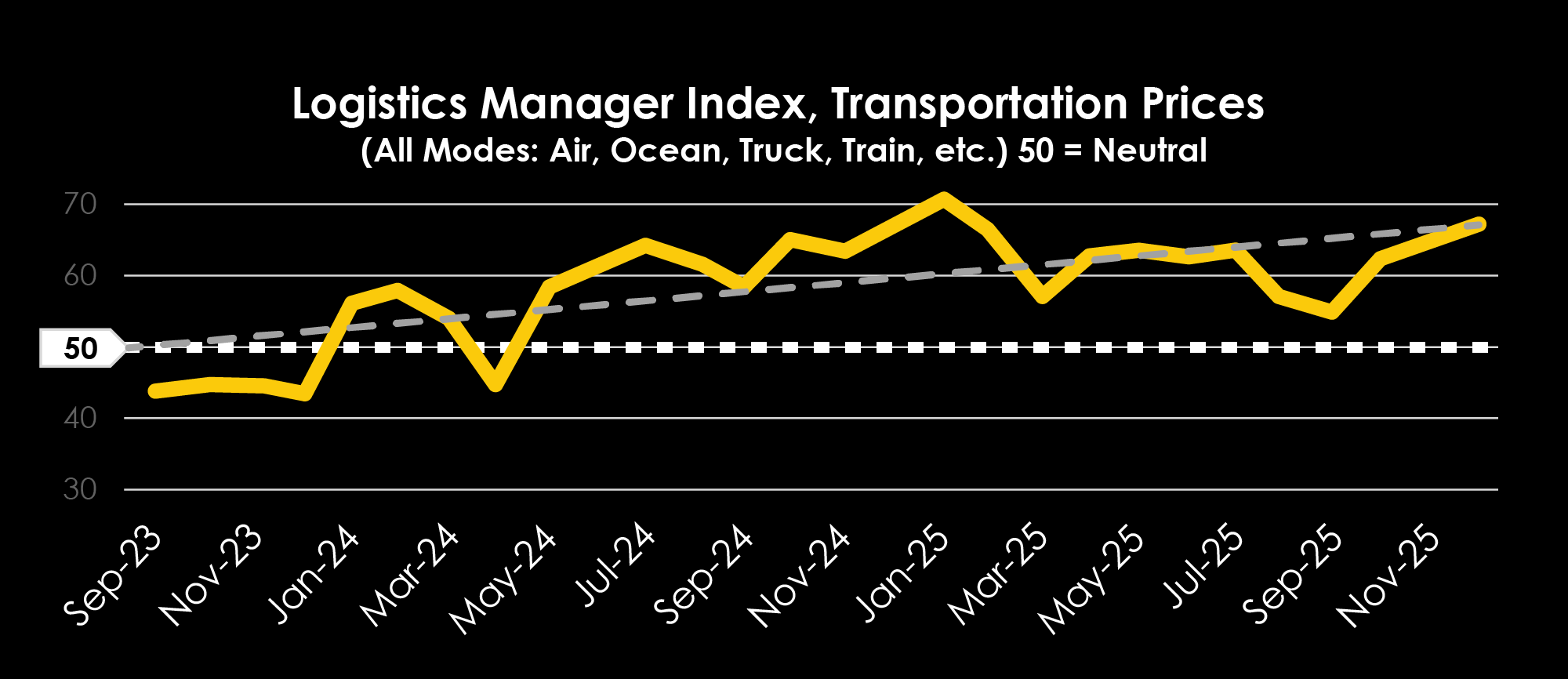

Transportation costs rose through the end of 2025 and into early 2026, even though overall freight demand and manufacturing activity remain slow. This means freight prices during peak 2025 increased not due to strong demand, but because fewer trucks were available.

Carriers continue to leave the industry as low rates, higher operating costs, and tighter regulations make it harder to stay profitable. After a relatively stable summer, the number of active trucking companies declined again late in the year and into January, reducing available capacity.

While freight demand remains soft today, the market no longer has much excess capacity. That means when demand does pick up, whether from seasonal shipping, weather events, or inventory restocking, rates are more likely to rise quickly.

As the market moves into 2026, conditions appear stable on the surface but are increasingly sensitive to change, with a greater risk of sudden rate increases.

Q4 transportation prices rose faster than in prior periods despite U.S. manufacturing continuing to contract

The Transportation Price index increased each month in Q4, with the LMI ending at 66.8, matching December 2024. This indicates rising transportation costs even as demand remained muted. Transportation capacity fell to its lowest level in four years, as the holiday surge could not be absorbed by a shrinking carrier base.

Source: LMI

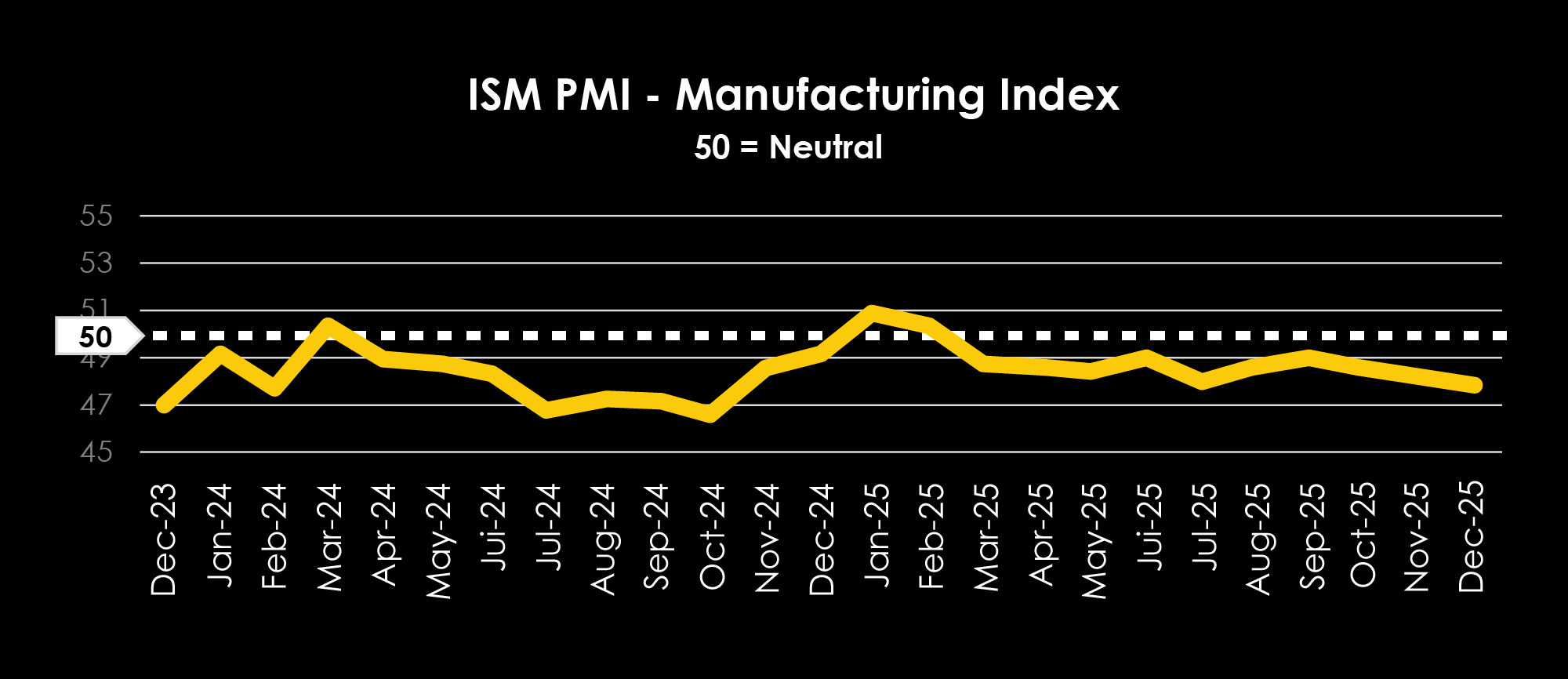

U.S. manufacturing continued its multi-year contraction. While computer and electronic products expanded modestly, most sectors declined, reflecting cautious inventory management and delayed restocking tied to trade policy uncertainty.

Source: PMI

u.s. trucking market

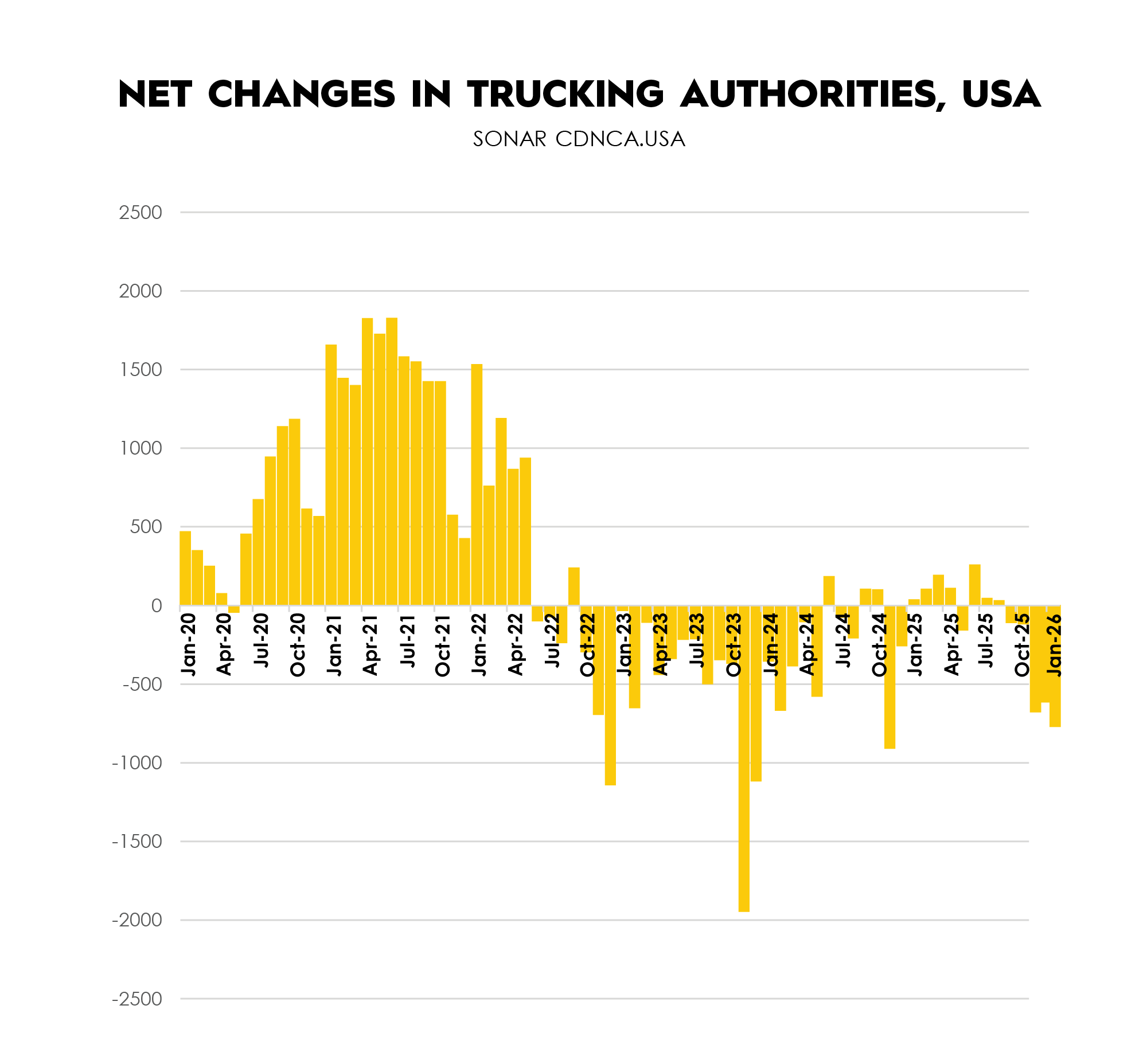

Low rates and elevated operating costs continue to drive carriers out of the market. After a stable summer, net trucking authorities declined again in November, December, and early January, confirming that carrier exits have resumed.

In addition to financial pressure, increased regulatory enforcement, including English-language requirements and non-domiciled CDL rules, presents further downside risk to available capacity, though impacts remain uneven by region.

Class 8 truck orders reached a three-year high in December, but this reflects delayed fleet replacements rather than net capacity growth. If capacity continues exiting at recent rates, the market will become increasingly vulnerable to rate increases when demand rises.

Source: FreightWaves SONAR – Jan 8, 2026; Class 8 Orders

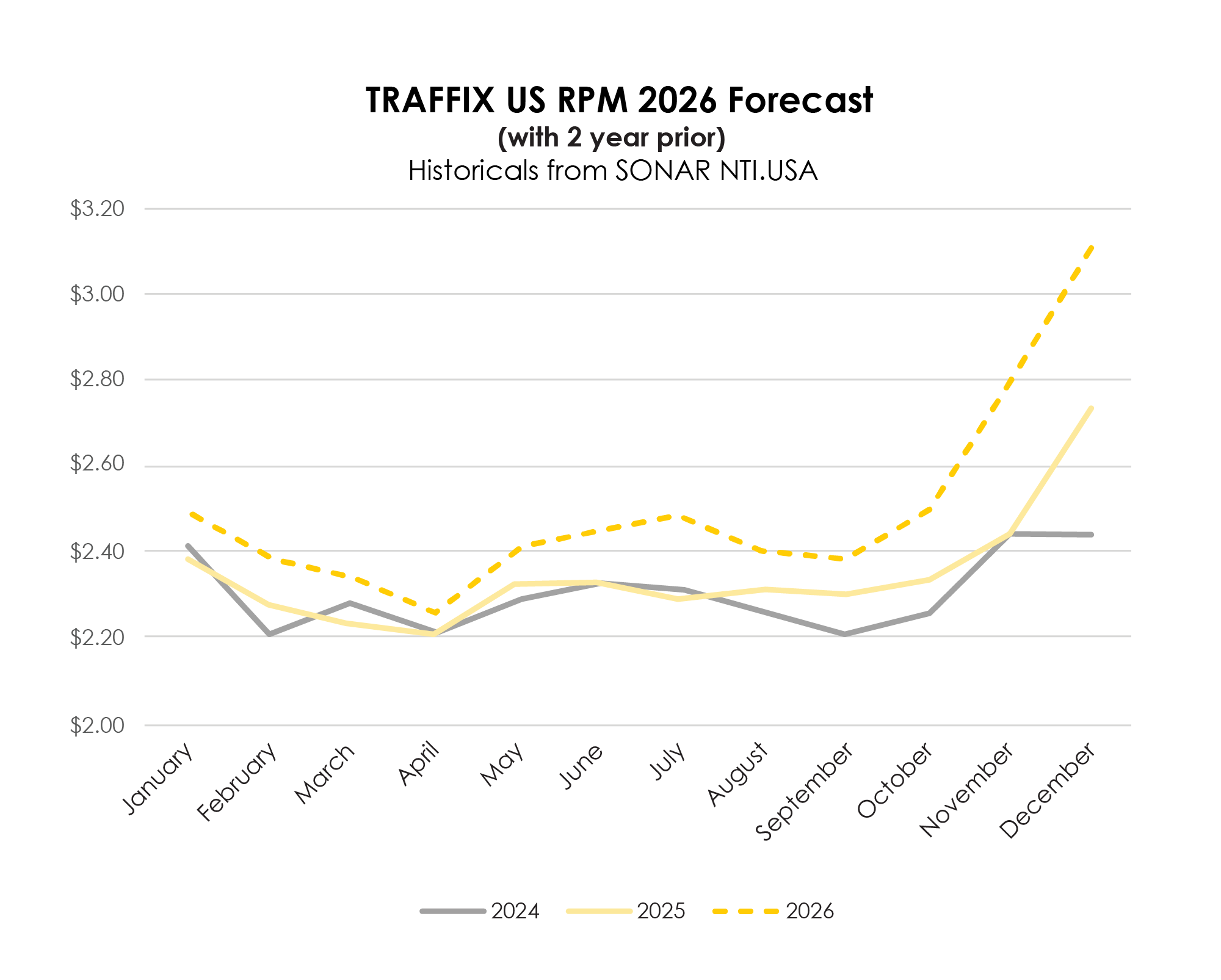

Rates forecasted to see moderate YoY increases, potentially driven higher by unexpected demand growth

- Truckload volumes remain down approximately 10–15% YoY entering Q1 2026.

- After multiple years of decline, volumes are expected to return to flat or modest YoY growth in Q2, aligned with produce season and improving housing activity.

- While demand remains soft, capacity has declined steadily for several years.

- Peak 2025 demonstrated that demand increases can no longer be absorbed without rate response.

- The TRAFFIX rate forecast expects minimal increases early in the year, followed by accelerating YoY rate growth beginning around Memorial Day, assuming volumes stabilize or improve.

(A/F = Actual / Forcasted)

TRAFFIX FORECASTS:

2026 BUDGETING GUIDANCE

Three Scenarios for Q1 2026 Freight Planning

- Volumes Stabilize, Capacity Tightens

Trade policy clarity improves, and volumes return to flat or modestly positive YoY growth. Capacity exits continue, limiting the market’s ability to absorb seasonal demand. Rates rise modestly in Q1, then accelerate starting with produce season and Memorial Day. Plan for freight rate increases of 4–6% in 2026, with stronger YoY gains in the second half. - Rate Increase Risk: Volumes Accelerate, Market Tightens Faster

Tariff reductions or repeals lower input costs and unlock restocking. Housing, consumer spending, and imports rebound faster than expected. Seasonal demand coincides with reduced excess capacity, driving sustained tightening. Rates increase minimally early in the year, then climb rapidly from late Q2 onward. Plan for 6–9% freight rate growth, led by long-haul truckload and reefer. - Volumes Stall, Volatility Increases

Trade policy uncertainty lingers, and consumer demand remains soft. Volumes stay flat or decline slightly, but capacity continues to exit due to unsustainable carrier economics. Rates remain stable early, then spike episodically around weather, produce, and holidays. Plan for 2–4% annual increases, with higher volatility rather than sustained inflation.

Planning Guidance:

Budget conservatively for mid-single-digit freight inflation in 2026, with limited relief after Q1. The primary risk is asymmetric impact, where even modest demand growth drives outsized rate increases due to reduced capacity. Monitor volumes, housing activity, and trade policy closely, as these will determine the speed and severity of rate escalation.

traffix forecasts:

FREIGHT MARKETS STEADY NEAR TERM,

SHIFTING TOWARD TIGHTER CONDITIONS

- Freight demand remained muted through most of 2025, until peak showed the fragility of capacity unable to handle increased volumes

- Truckload capacity continues to exit the market, driven by unsustainable carrier margins and increased regulatory enforcement

- Consumer spending and housing activity will determine whether seasonal demand triggers sustained tightening in 2026

- Q1 rates are likely to show minimal growth after returning to normal from peak, but Q2 could see rate increases accelerate

- Manufacturing remains soft but stable, with a potential rebound emerging by mid-2026 if demand improves

- Rate increases are expected regardless of scenario, with demand determining whether outcomes fall closer to the lower end of 2–4% or escalate toward 6–9% or higher.

RECCOMENDATIONS

Plan for Asymmetric Risk:

Rates may remain stable early, but reduced capacity creates risk for rate increases once demand improves. Budgeting should assume faster escalation later in 2026.

Optimize Mode and Lane Strategy Now:

Use current rate stability to rebalance modal mix, including intermodal and regional carriers, to reduce exposure during peak and seasonal tightening.

Secure Capacity Ahead of Replenishment Cycles:

As inventories normalize, demand could rebound quickly. Strengthen carrier partnerships and position contract capacity before the next restocking cycle.

SUBSCRIBE TO TRAFFIX’

MARKET INSIGHTS

"*" indicates required fields