TRAFFIX Trends Q3 2025

Published: July 15, 2025

Last Updated: February 4, 2026

KEY MARKET INDICATORS

Q3/Q4 Freight Market Hinges on Consumer

Demand and Tariff Fallout

Freight markets in Q2 were shaped by shifting trade policy, including a brief influx of Chinese imports following tariff reductions. This led to a surge of port activity and rapid inventory buildup. With warehouses now full, the pace of consumer demand will dictate how quickly these inventories deplete and when restocking-driven freight demand returns.

Intermodal has gained share from long-haul truckload, as shippers favor deferred, lower-cost options for non-urgent freight. Looking ahead, truckload spot rates could rise if economic activity rebounds, but persistent inflationary pressure from tariffs may suppress consumer spending, prolonging sluggish demand.

The freight market is operating with reduced capacity compared to previous years due to carriers exiting the market.

This has created conditions for increased rate volatility, including regional surges.

Geopolitical instability, particularly in the Middle East, adds further uncertainty. Any disruption in the Strait of Hormuz could spike oil and diesel prices, impacting carrier operating costs and potentially tightening capacity further.

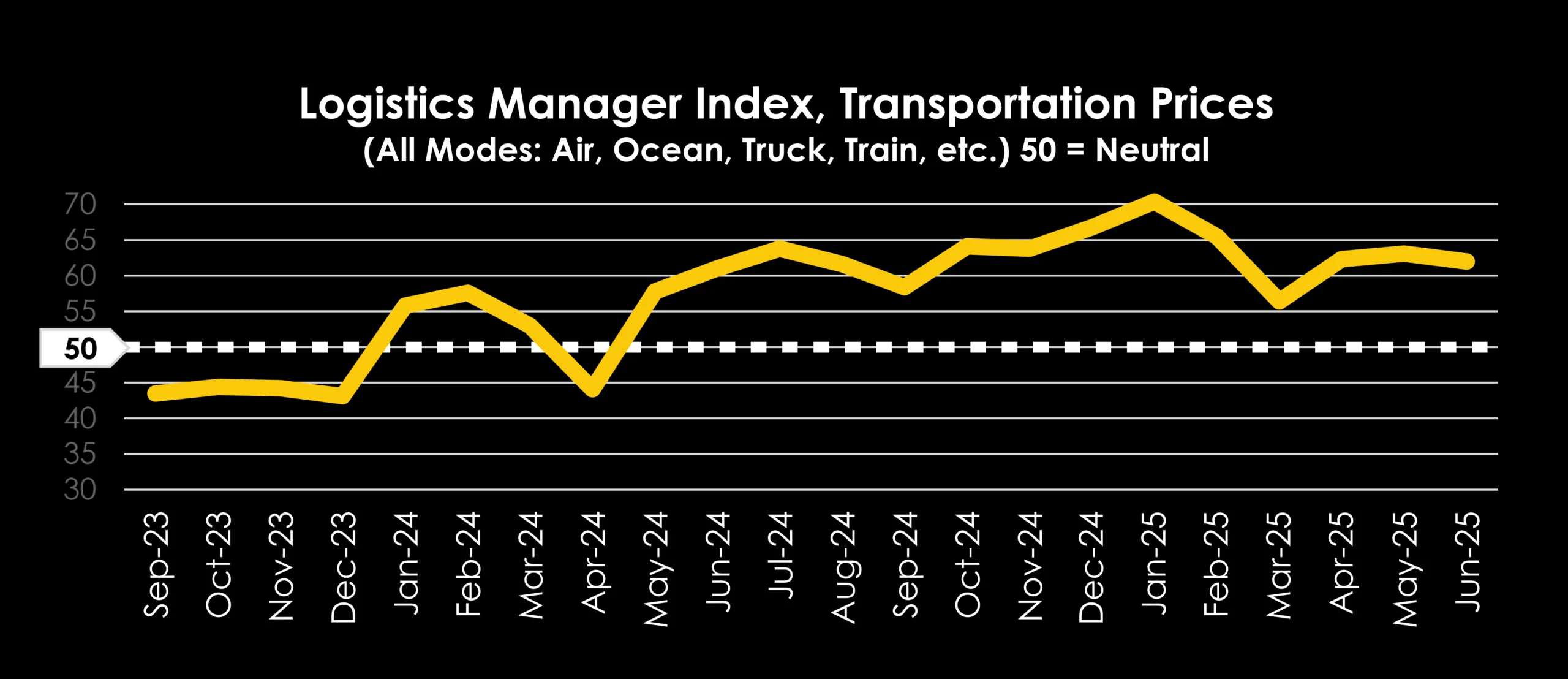

Q2 transportation rates up and predicted to rise while us manufacturing faces a slight contraction

The Logistics Manager Index (LMI)-Transportation Prices, showed strong readings of price increases. Since the metric covers all modes, the temporary jump in ocean rates is a key driver of transportation price increases as trucking rates experienced stable seasonal shifts. LMI survey respondents expect freight rates across all modes to increase over the next 12 months.

Source: LMI

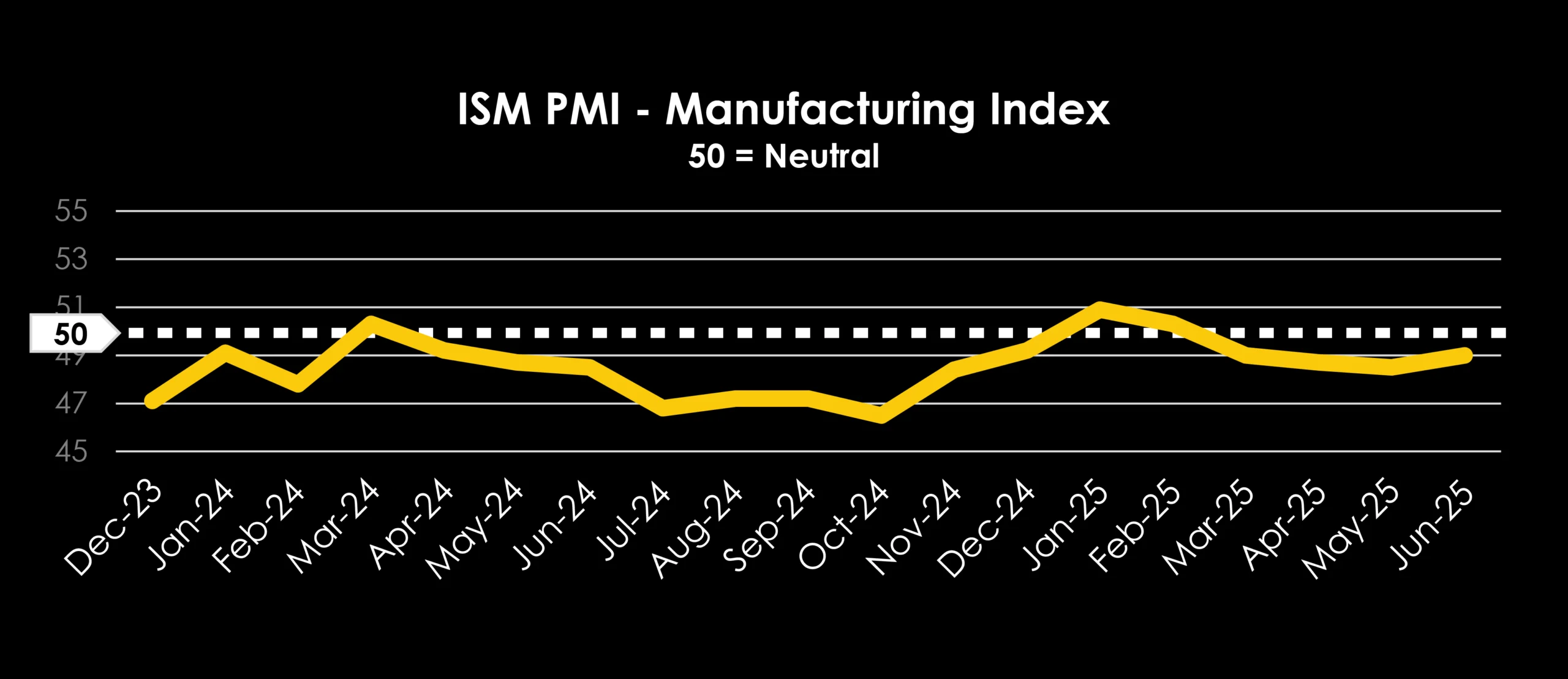

US manufacturing returned to its long-term trend of contraction in Q2, according to the Purchasing Manager’s Index (PMI). Q1 saw two readings of expansion, but March through June results return to a cooling manufacturing sector. June’s reading of 49 (where 50 is neutral) suggests the contraction is minor, and the US could see future upside if consumer spending and demand increases in Q3 & Q4.

Source: PMI

u.s. trucking market

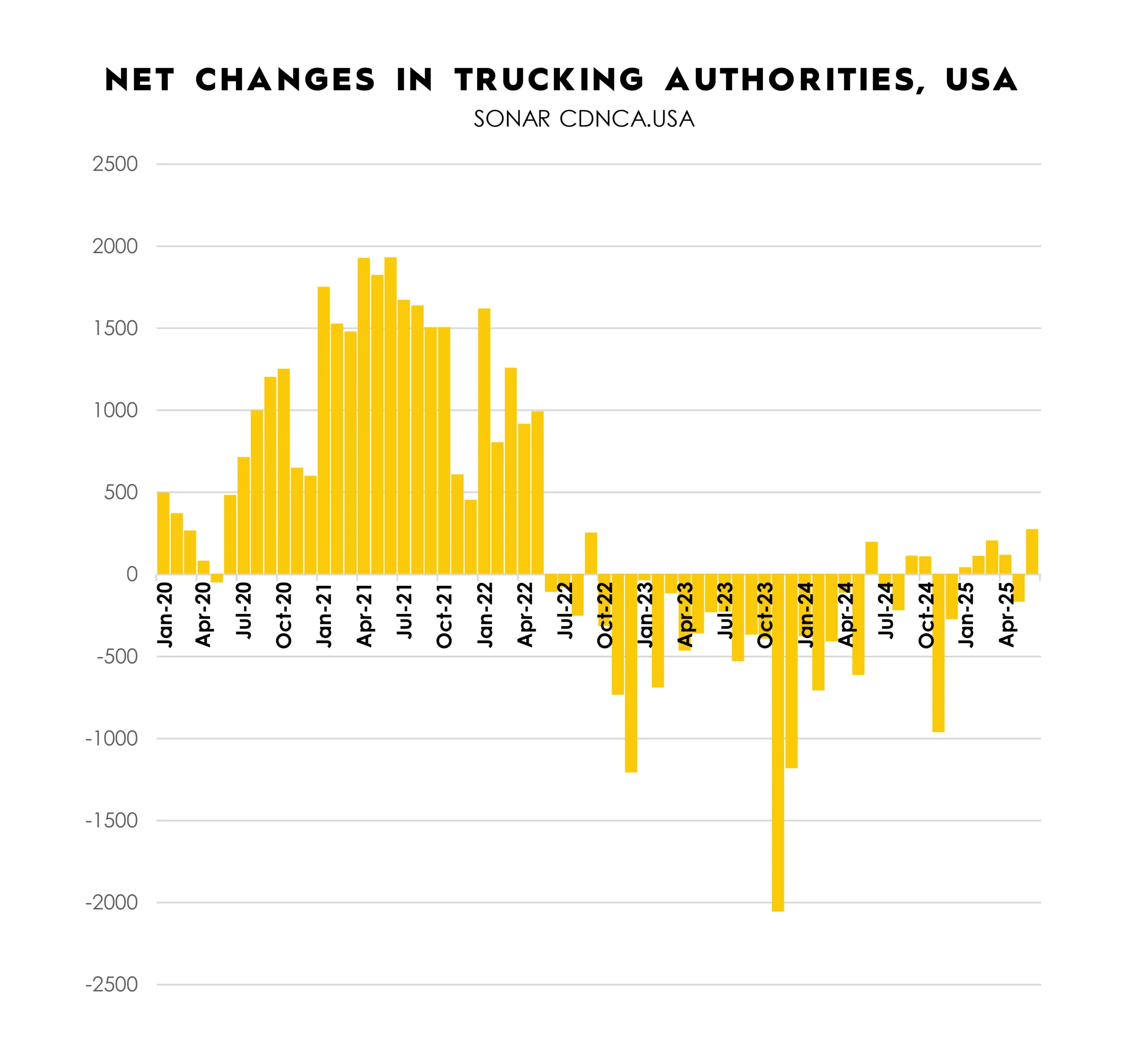

Over the past several years, a growing number of trucking companies in North America secured the necessary authorities to enter the market, contributing to an increase in industry capacity. However, similarly to the market shift in 2022, many of those companies exited, leading to a reduction in capacity.

Then, as the market flipped in 2022, many of those companies closed and capacity decreased.

Since mid-2024, supply and demand in the trucking market have been moving toward equilibrium. Freight demand has continued to decline, and although capacity is leaving the market, it’s doing so at a slower pace.

Q2 2025’s numbers show the market continuing in an equilibrium state, with slightly positive net change in 5 out of the past 6 months of 2025.

Overall capacity seems to be more closely aligning with demand as tender rejection rates have trended up to historical averages of balanced markets. If there is a shock in demand, the capacity may be unable to cover large growth without higher rates to bring in more capacity.

Source: FreightWaves SONAR – July 3, 2025

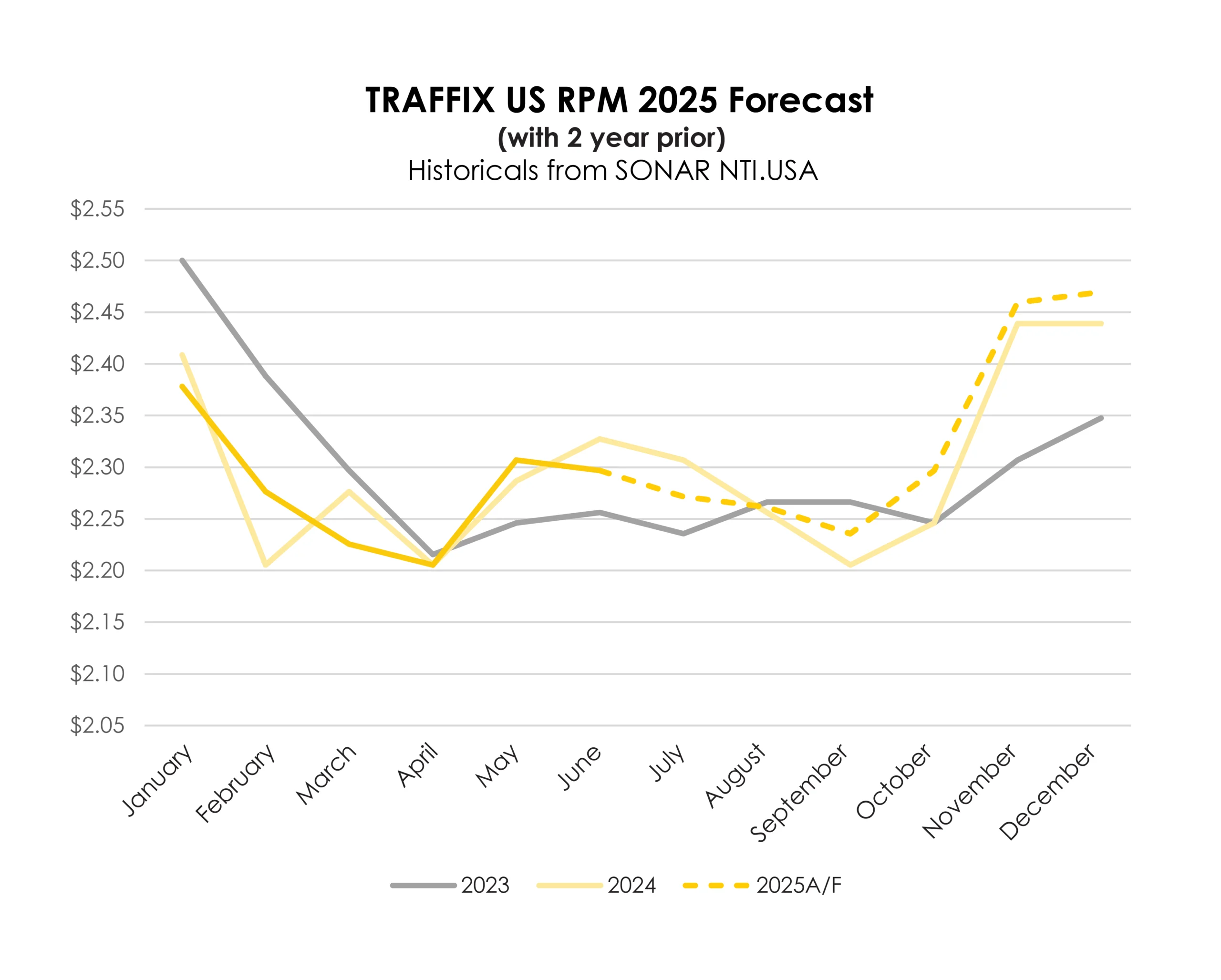

Rates forecasted to average near prior-year

levels, but with increased volatility

- A key factor influencing Q3 and Q4 freight rates will be the speed at which proactively imported inventory (brought in ahead of anticipated tariffs) is drawn down by consumer demand and needs replenishment.

- Freight volumes are down year-over-year as construction, ecommerce, and durable goods spending remains muted. Since the surge in imported inventory is not immediately needed on shelves, intermodal has been handling a larger share of long-haul freight. Long haul freight volume was down ~23% YoY in Q2, compared to Intermodal being roughly flat to last year.

- Capacity is sitting closer to equilibrium with demand, so expect increased volatility in rates around holidays and regional shortages, including temporary jumps in rates of 15% or more for cities and states facing swings in outbound volume.

- Diesel fuel rates could be impacted significantly by geopolitical events in the Middle East, especially with a potential blockade of the Straight of Hormuz.

- The updated freight rate forecast anticipates average rates remaining near 2024 levels, with increased volatility, a modest year-over-year rise in Q4, and localized fluctuations of ±10% or more.

(A/F = Actual / Forcasted)

Source: FreightWaves SONAR – July 3, 2025

traffix forecasts:

Freight rates expected to remain near 2024 averages through q4, with increased volatility

- Tariff-driven inventory surges filled warehouses in Q2; restocking timing depends on consumer demand.

- Spot rates expected to hover near 2024 averages, with increased volatility around holidays and regional disruptions.

- Intermodal gaining share over long-haul truckload for deferred, lower-cost freight.

- Truckload capacity remains tight, especially among small fleets—limiting flexibility if demand rebounds.

- English language rule enforcement has the potential to further tighten capacity.

- Consumer demand will shape whether rates increase or remain soft.

- Geopolitical risks in the Middle East, including the Strait of Hormuz, may trigger diesel price volatility.

- Manufacturing remains soft but stable; PMI suggests potential rebound if demand improves.

RECCOMENDATIONS

Build Resilience into Every Plan:

With ongoing volatility in trade, fuel, and geopolitics, flexibility is essential. Develop layered contingency plans across procurement, carriers, and modes. Keep plans current with market data and align teams and vendors so pivots can happen quickly.

Prioritize Flex Capacity and Regional Coverage:

Stable national rates mask sharp regional swings of ±10%. Now is the time to secure dependable partners who can flex in tight markets, especially near ports, in produce zones, and on reefer lanes. Make sure your backups are executable.

Diversify Your Network Strategy:

Import surges disrupted networks in Q2. Reassess your distribution footprint, port reliance, and long-haul strategy. Regional warehousing, nearshoring, and transloading can offer quick wins. Diversification isn’t just long-term planning; it’s a short-term edge.

SUBSCRIBE TO TRAFFIX’

MARKET INSIGHTS

"*" indicates required fields