TRAFFIX Trends Q4 2025

October 16, 2025

KEY MARKET INDICATORS

Freight markets steady but fragile as inventories remain high and policy impacts loom

Trade policy uncertainty has been the defining factor in the 2025 freight market. Many importers accelerated shipments early in the year to avoid new tariffs, leading to swollen warehouse inventories and a subsequent decline in freight demand. Higher interest rates are now weighing on business investment and employment, signaling a broader economic slowdown.

Tariff-related cost increases have not yet fully appeared in inflation data, but they are expected to emerge as pre-tariff inventories are replaced. In the meantime, shippers have shifted long-haul freight to intermodal to reduce costs, driving a 20–30% year-over-year decline in truckload volume. Overall trucking demand is down roughly 20% from last year, with capacity continuing its multi-year contraction alongside softer volumes.

Rates have remained near 2024 levels, and tender rejections have risen to around 5%, suggesting a gradual tightening between supply and demand. Government action on illegal immigration, English-language requirements, and visa eligibility has further constrained available capacity in several regions.

As the market enters the Q4 peak season, several variables could determine direction in the months ahead. Consumer spending remains the key driver of freight demand. Strong holiday sales could draw down inventories and lift rates, while weaker spending would keep volumes flat. Inflationary pressures from delayed tariff impacts and rising unemployment could limit consumer purchasing power. Carrier exits are expected to continue as rates remain below sustainable margins, and new policy enforcement may trigger localized capacity gaps even if national demand stays subdued.

The market heads into Q4 at an inflection point, with consumer behavior, tariff effects, and regulatory changes set to determine whether freight demand stabilizes or remains muted into early 2026.

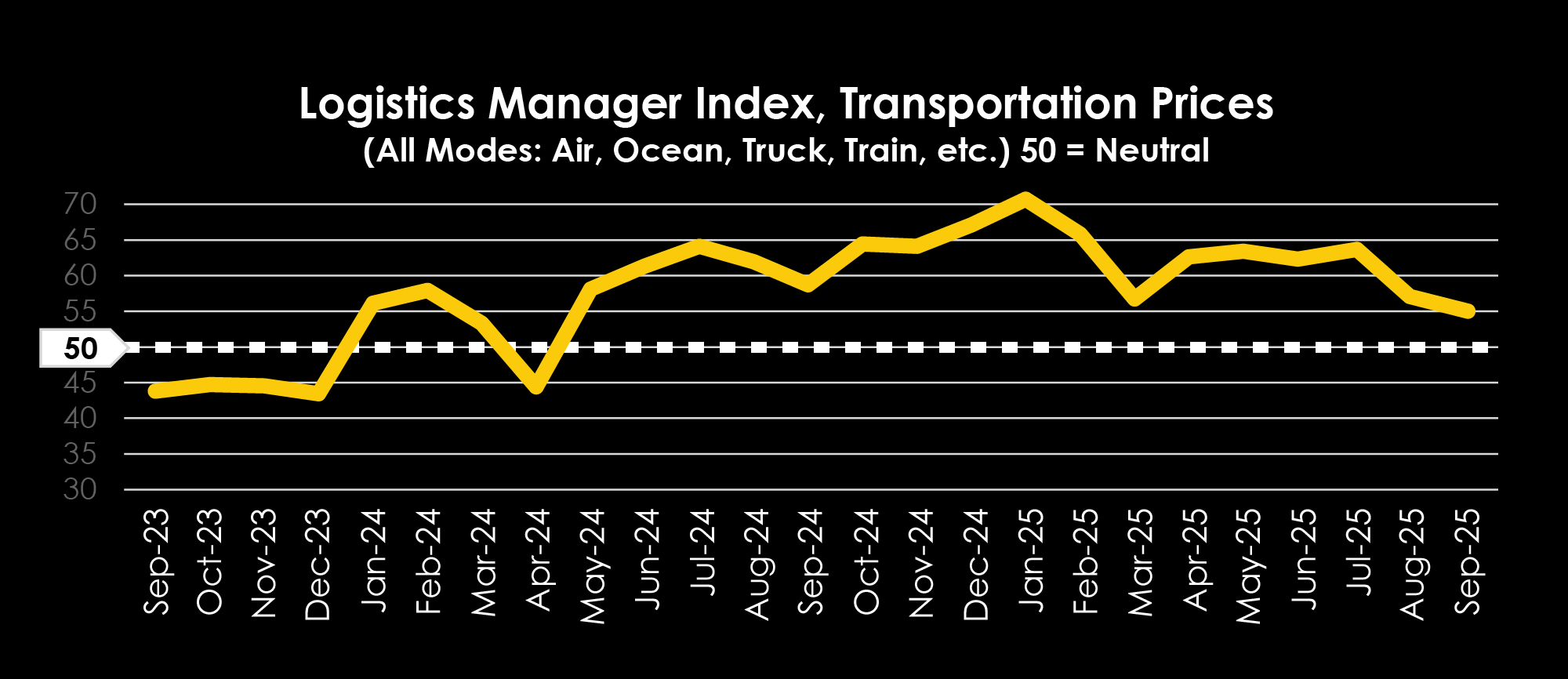

Q3 Transportation Prices Slowed their Increases as US Manufacturing Continues its Multi-year Contraction

The Logistics Manager Index (LMI)-Transportation Prices increased at a slower rate in Q3 than earlier in the year. Demand for freight declined as inventories remained full. LMI respondents anticipated an increase in rates over the next 12 months, but at a much slower rate than earlier in the year.

Source: LMI

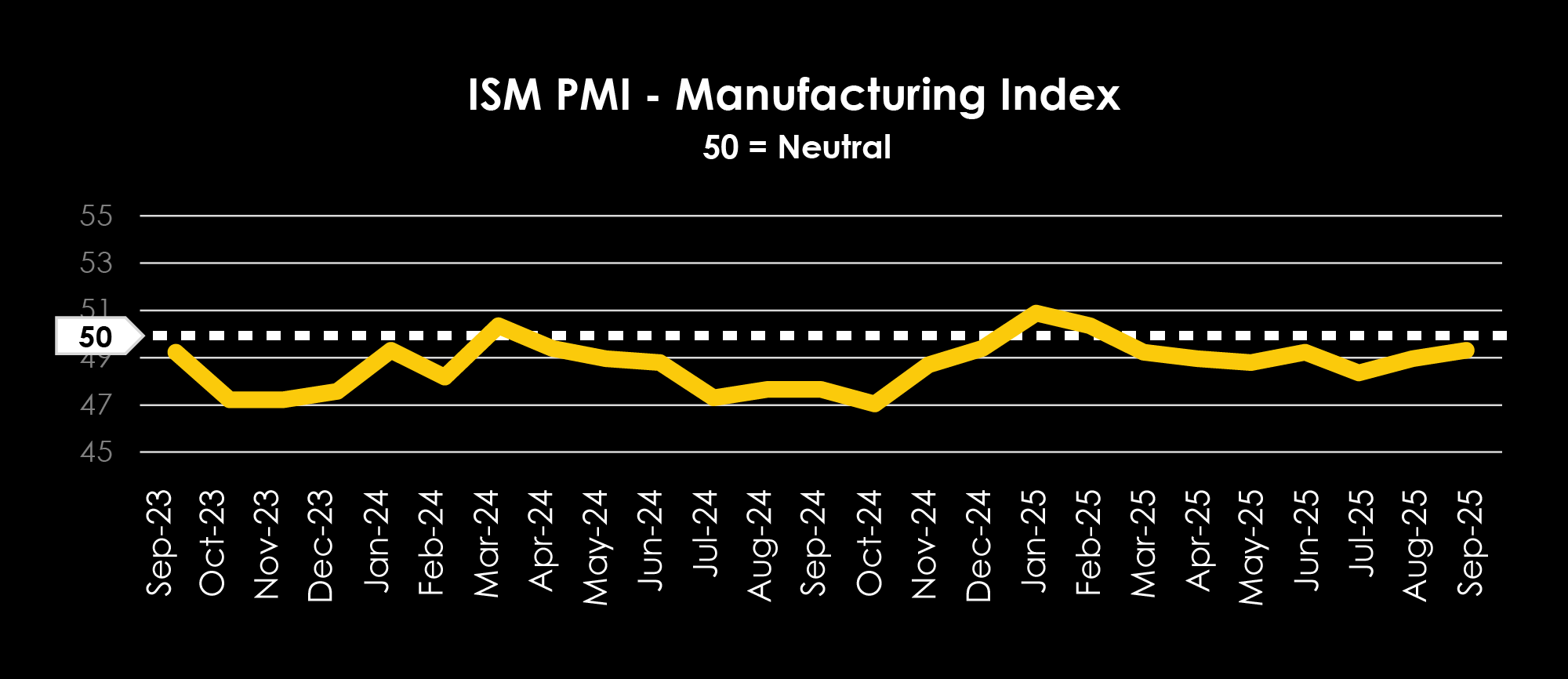

US manufacturing continued its over two-year contraction in Q3 according to the Purchasing Manager’s Index (PMI). Production, pricing, and supplier deliveries are increasing, but new orders, employment, and exports are holding back the sector from overall growth.

Source: PMI

u.s. trucking market

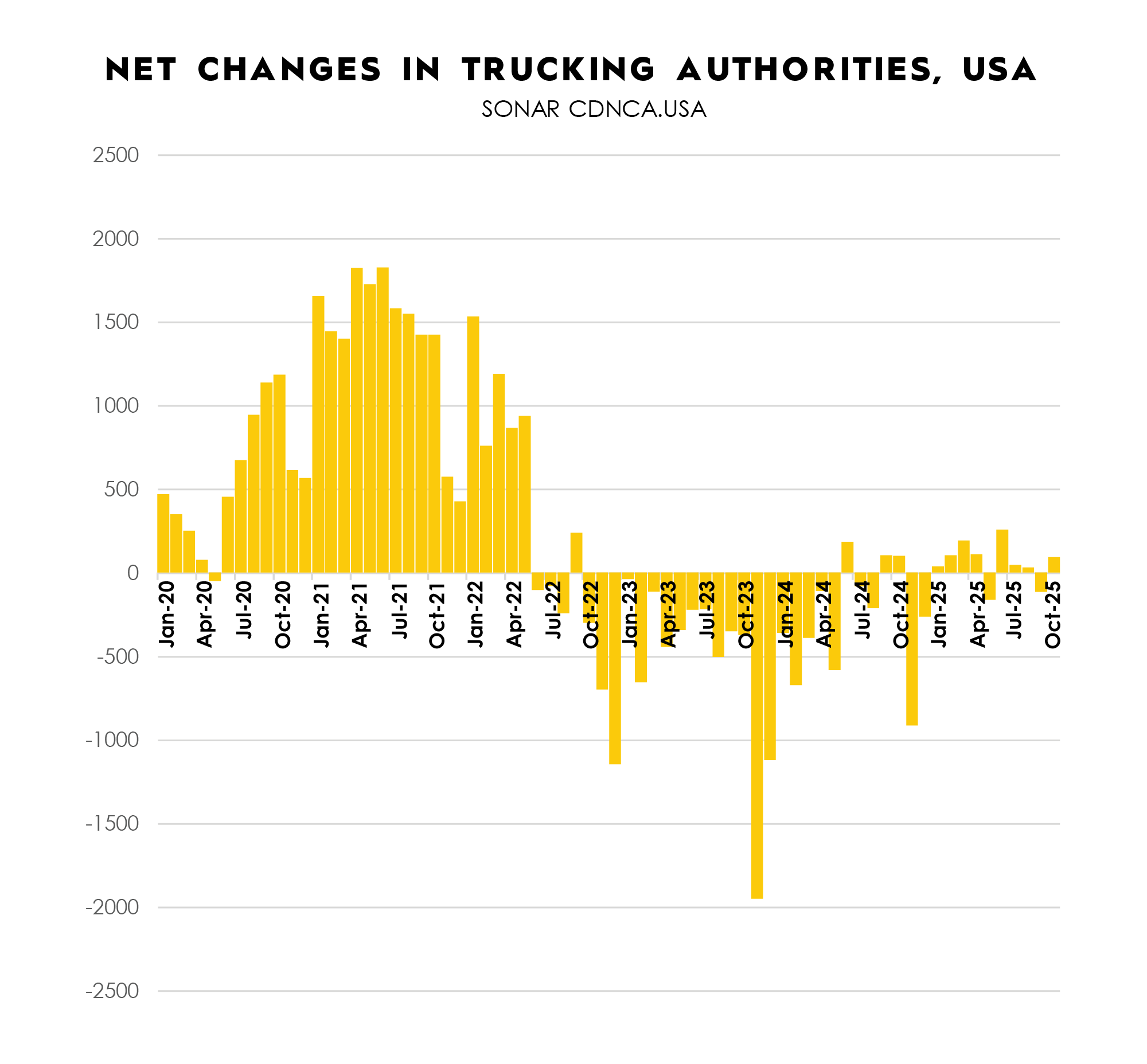

As trucking freight demand has decreased YoY, so has the capacity to move that freight. The net number of trucking authorities has hovered around a net neutral to negative number for several years. Dozens of carrier bankruptcies have made headlines, and orders for new trucks has stalled.

Adding to the economic pressures pushing out carriers, government policy enforcements are also playing a role in capacity. English-language rules, immigration enforcement, and visa requirements are all expected to have an impact in the medium term across different regions. These regional impacts will be felt nationwide, however, as capacity adjusts to demand.

If capacity restriction remains in line with declining demand, then rates could remain stable. However, if demand were to increase quickly, then we could see freight rates rise quickly until more capacity can be added.

Source: FreightWaves SONAR – October 10, 2025

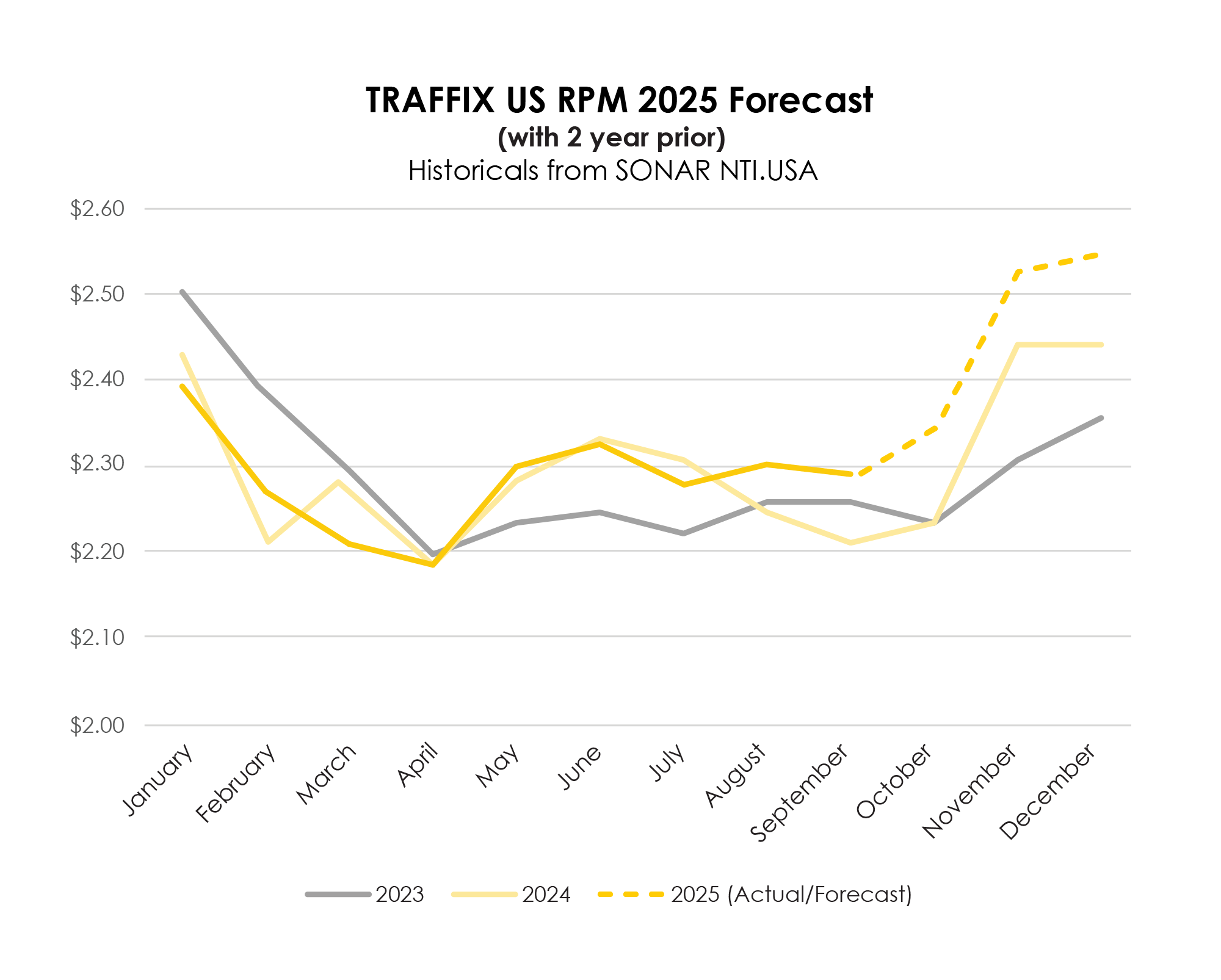

Rates forecasted to see moderate YoY increases, potentially driven higher by unexpected demand growth

- Truckload freight demand is down ~20% YoY heading into Q3.

- The volume decrease is influenced by two factors: (1) the pull-forward of inventory earlier in the year due to trade policy uncertainty, and (2) the increased use of intermodal freight for longer distance loads.

- Capacity has generally followed the decline of volume, keeping rates close to prior-year levels so far in 2025.

- Peak season has two likely rate outcomes:

- Rates will hover around 2024 levels – this depends on how well companies have already moved inventory to their correct locations, and demand meeting anticipated levels.

- Rates rise above 2024 rates, potentially much higher – if demand is unexpectedly strong, and inventory needs to be expedited downstream, then rates could see moderate jumps of 5-15%+ over last year.

- The TRAFFIX rate forecast expects moderate increases YoY around 5%, with some regional jumps as capacity is insufficient for demand.

(A/F = Actual / Forcasted)

Source: FreightWaves SONAR – October 10, 2025

TRAFFIX FORECASTS:

2026 BUDGETING GUIDANCE

- Trade Policy Stabilizes

If trade policy becomes consistent and more predictable, confidence will return to capital investment and manufacturing. Inflation from earlier tariffs will linger, but predictable input costs will allow businesses to plan inventory replenishment and moderate hiring. Consumer spending and imports should recover gradually, leading to an increase in freight demand and freight rate increases of 2–4% with a return toward more predictable seasonality. - Trade Policy Improves

A rollback of tariffs or easing of trade restrictions would reduce import costs and accelerate goods flow through ports. Lower inflation and interest rates would support stronger consumer spending and inventory restocking, while unemployment remains steady. Increased demand could tighten capacity by midyear, resulting in freight rate growth of 4–7%, led by long-haul truckload and reefer. - Trade Policy Remains Unpredictable

Ongoing tariff volatility, inflation uncertainty, and geopolitical risk would delay business investment and keep inventories elevated. Weak consumer spending, higher unemployment, and sustained high interest rates would limit restocking and compress margins. Capacity would continue to exit the market, keeping rates largely flat, but volatility would rise around disruptions or policy shifts.

Planning Guidance:

Budget conservatively for a ±5% freight rate range in 2026, depending on how trade policy and macroeconomic indicators evolve. Watch consumer spending, inflation, and geopolitical developments closely, since those will determine whether 2026 delivers a stable recovery or another year of cost uncertainty.

traffix forecasts:

Freight markets steady Headed

into peak, poised for transition

- Early inventory pull-forwards and policy uncertainty kept freight volumes muted through Q3

- Rates remain close to 2024 averages, but volatility is increasing as capacity tightens regionally

- Intermodal continues gaining share from long-haul truckload for deferred and lower-cost freight

- Truckload capacity continues to contract as small carriers exit amid unsustainable margins

- Enforcement of English-language, visa, and immigration rules is reducing available capacity in some regions

- Consumer spending will determine whether rates lift during peak or stay near prior-year levels

- Elevated inventories and delayed tariff impacts could limit restocking until early 2026

- Manufacturing remains soft but stable; a modest rebound could emerge by mid-2026 if demand improves

RECCOMENDATIONS

Anticipate Capacity Shifts Early:

Proactively identify markets likely to tighten due to regulation or seasonality. Align spot, contract, and intermodal strategies now to avoid last-minute coverage challenges during Q4 and early 2026.

Rebalance Mode and Lane Strategy:

Use current low truckload rates to reassess modal mix. Evaluate where intermodal and regional carriers can add resilience without sacrificing service time or cost control.

Prepare for Replenishment Demand:

As inventories normalize in early 2026, freight demand could rebound quickly. Strengthen relationships with high-performing carriers and position capacity agreements ahead of the next restocking cycle.

SUBSCRIBE TO TRAFFIX’

MARKET INSIGHTS

"*" indicates required fields