Do Asset-Based Carriers Ever Broker Loads?

Published: October 15, 2025

Last Updated: February 23, 2026

Asset-based carriers have direct relationships with shippers. To keep their trucks generating revenue consistently, they need a broad customer base, including brokers, 3PLs, and 4PLs, to ensure a steady flow of freight. The volume they can handle, however, is limited by the number of assets they own and their geographic positioning.

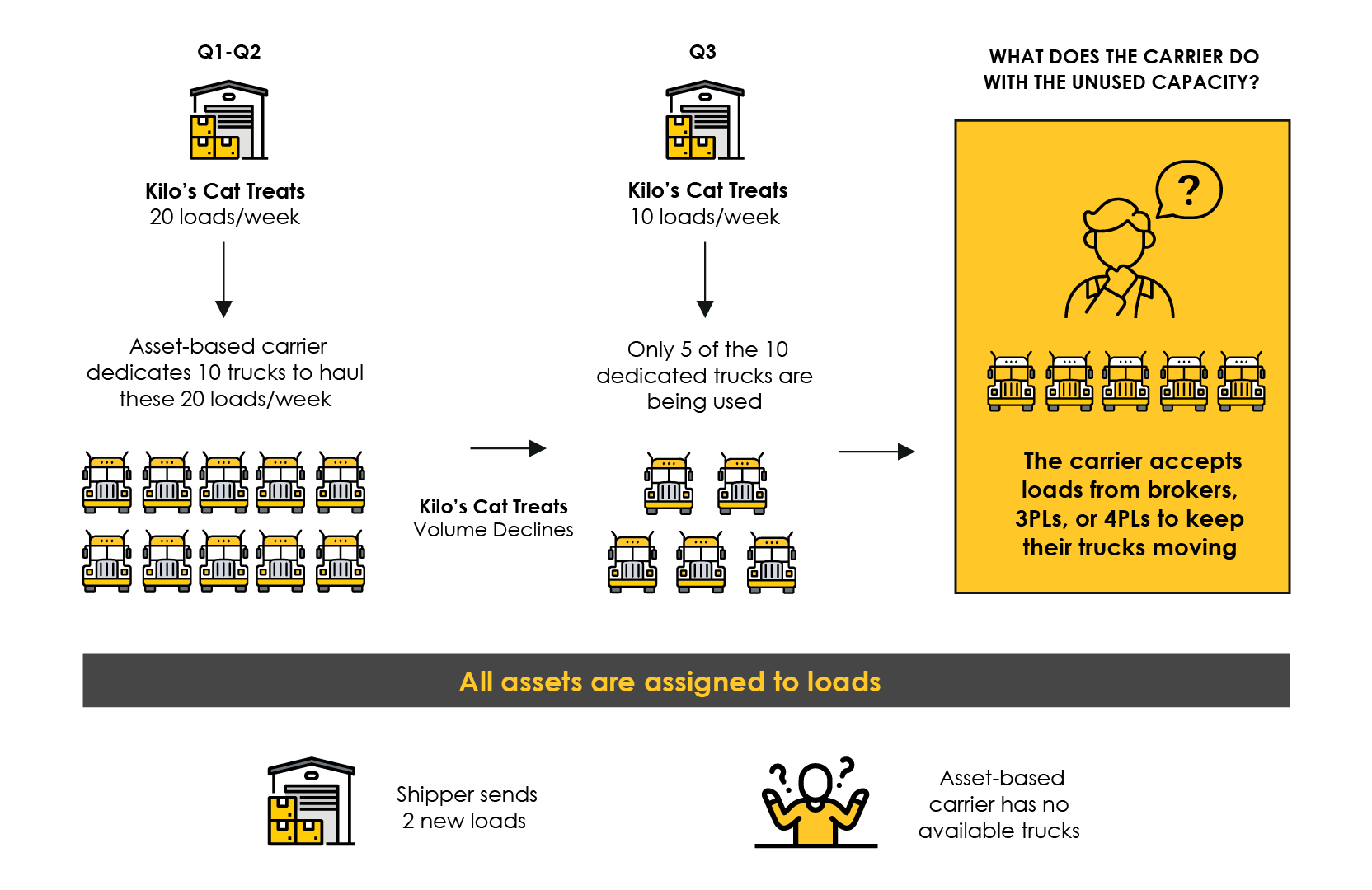

At times, an asset-based carrier’s direct customers may experience slow periods. To keep their trucks moving, the carrier may accept loads from other sources. This can create a problem when their direct customers suddenly need freight moved, but the carrier’s assets are already committed elsewhere.

How fluctuating volumes can cause

capacity issues on dedicated lanes

Fluctuating volumes from an asset-based carrier’s direct customers puts the carrier in a difficult position based on two key factors:

STRICT KPIs

Maintaining Relationships

Many shippers hold carriers accountable to key performance indicators (KPIs), including tender acceptance rates. Rejecting a load could result in penalties or even the loss of business.

By canceling previously secured loads to take unexpected shipments from a direct customer, the carrier risks damaging relationships with brokers or other sources of freight.

This puts the carrier between a “rock-and-a-hard-place”. The carrier must either reject the freight from their direct customer and risk damaging that relationship or they need to broker the load to another carrier, so they don’t let either customer down.

The following infographic illustrates how unused truck capacity often forces asset-based carriers to accept loads from alternative sources. When shipper volumes rebound, this reallocation creates challenges, as those carriers must once again provide the dedicated capacity that was temporarily diverted out of necessity.

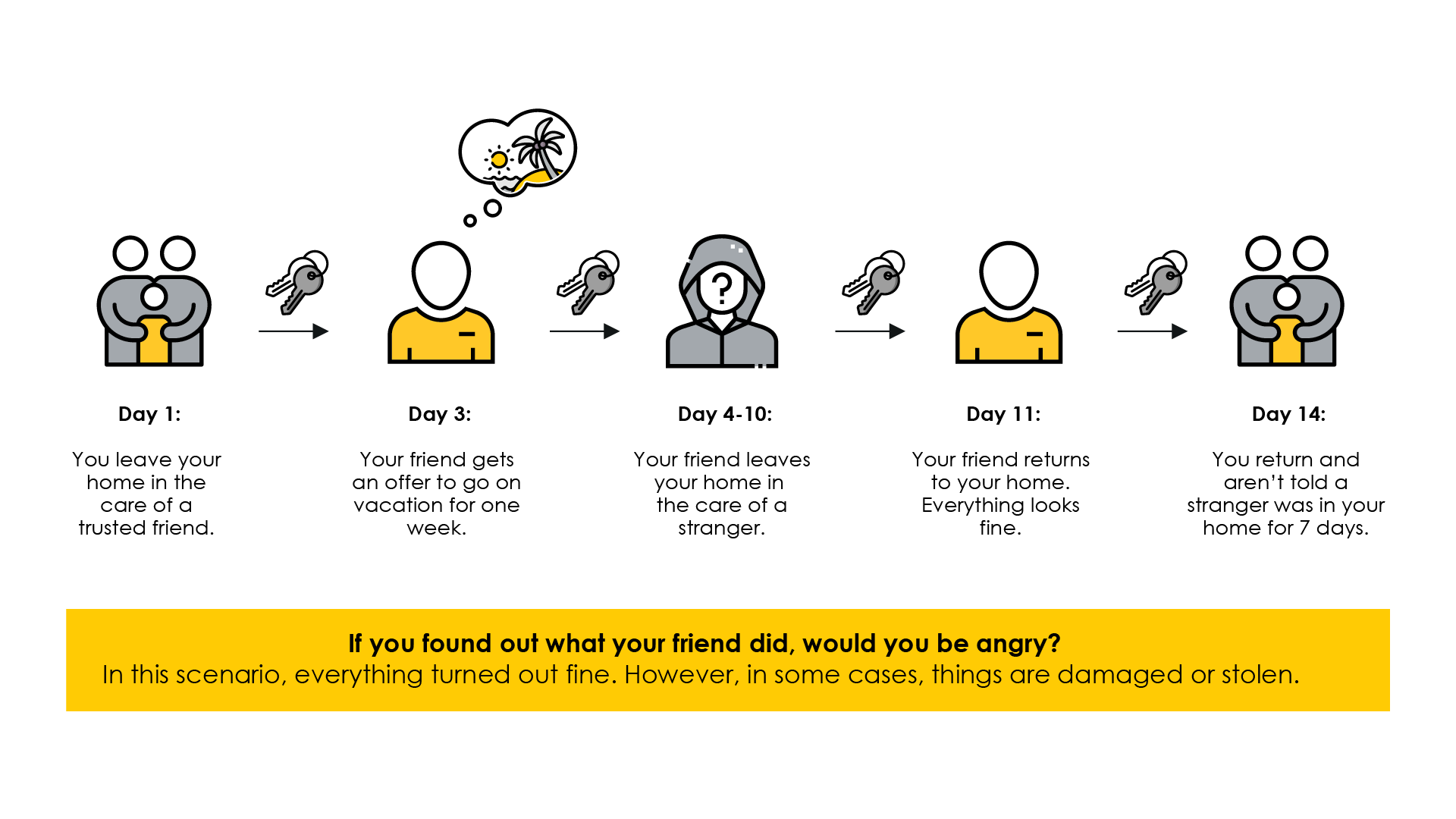

Brokering the load to another carrier is considered unethical in the freight world. Shippers doing business directly with an asset-based carrier do not authorize them to give their cargo to another carrier they have not vetted.

To better understand why unauthorized brokering is such a problem in freight, let’s look at a simple analogy: leaving your house in the care of a friend.

Sometimes asset-based carriers broker loads they receive from a broker, 3PL, or 4PL. This is considered unauthorized brokering, a practice that is highly unethical and, in some cases, illegal, such as in the USA under MAP-21 legislation.

What’s the difference

when a 4PL brokers freight to a 3PL?

When a 4PL knowingly assigns freight to a vetted 3PL with whom they have a formal contract, this is referred to as co-brokering. In this scenario, the 4PL tendering the load is fully aware that the 3PL will assign it to a carrier within their network, and the appropriate contractual agreements are in place to support this arrangement.

Unauthorized brokering, by contrast, is distinguished by its unauthorized and deceptive nature, where parties involved are often unaware of the additional layer of brokerage.

Do All Asset-Based Carriers

Broker Freight?

No. Many asset-based carriers avoid brokering freight altogether, even if it means turning down loads and risking the loss of business.

Are There Risks When Asset-Based

carriers Broker Freight?

Yes, and they can be significant:

- Lack of Proper Vetting: Unlike professional brokers or 3PLs, many asset-based carriers lack the processes and tools to properly vet outside carriers.

- Inconsistent Networks: Because they do not consistently tender freight to external carriers, they may not maintain a reliable network of partners.

- Increased Risk: This can lead to higher risks of cargo loss, liability issues, and damage to both their own and the shipper’s reputation.

What Should Shippers Consider?

If you prioritize using only asset-based carriers, especially on high-volume lanes with strict KPIs, you should be aware that these situations can arise. In such cases, working with a broker or 3PL offers greater flexibility and reliability, as they can manage capacity more effectively and maintain vetted networks.

If you insist on using only asset-based carriers, one way to avoid them brokering your loads is to offer grace when they need to reject a load due to capacity restrictions. Lifting strict load acceptance KPIs will relieve the fear of losing your business which often pushes them into a brokering situation.

For high-demand lanes, a broker or 3PL may ultimately be the better choice for ensuring consistent service and meeting performance metrics.

Why do Shippers Prefer Asset-Based Carriers?

Debunking Common Misconceptions

Shippers may insist on using only asset-based carriers over brokers for several reasons, often related to perceptions of control, reliability, and consistency. Let’s look at some of the primary reasons asset-based providers are preferred and debunk some common misconceptions.

WHY SHIPPERS PREFER

ASSET-BASED CARRIERS

DEBUNKING

MISCONCEPTIONS

- Shippers may prefer to work directly with asset-based carriers because they believe it offers more control over the shipment process.

- They may feel that working with a carrier that owns the equipment provides better visibility and accountability.

- 3PLs are staffed with transportation experts who have established long-term relationships with carriers.

- Thanks to the high volume of freight they provide, 3PLs benefit from carrier loyalty and transparent communication.

- In cases of accidents, delays, or breakdowns, 3PLs handle the problem-solving process, often resolving issues without involving the shipper.

- This allows 3PLs to maintain control, accountability, and shipment visibility, ensuring the success of the load.

- By dealing directly with asset-based carriers, shippers avoid the additional layer of communication and coordination that brokers introduce.

- This can streamline decision-making and reduce potential misunderstandings.

- There is no additional layer of communication needed when working with a 3PL. In fact, shippers can consolidate most or all their supply chain with a 3PL and work with a single point of contact for everything.

- Since 3PLs hire transportation experts, there is low risk of misunderstandings. Experienced account managers know what questions to ask to ensure streamlined shipments and will trouble shoot any problems that arise in transit.

- Asset-based carriers typically offer dedicated equipment, which can be more reliable, especially for high-volume lanes.

- Shippers may feel more assured knowing that a carrier owns the trucks and is directly responsible for ensuring their availability.

- 3PLs can secure dedicated capacity on high-volume lanes by partnering with contracted carriers and owner-operators.

- When freight volumes decrease, a 3PL can leverage their broader network to keep carriers engaged with other shipments, ensuring they maintain their revenue and don’t abandon contracts.

- If demand spikes on a high-volume lane, 3PLs can quickly respond by providing additional vetted capacity to meet the increased need.

- Some shippers may have concerns about unauthorized brokering, a situation where freight is passed through multiple brokers without the shipper’s consent. This can lead to issues such as missed delivery times or liability for lost or damaged goods.

- By working directly with asset-based carriers, shippers may believe they are mitigating the risks associated with this practice.

- 3PLs implement robust processes to prevent and detect unauthorized brokering, protecting shippers from potential risks.

- As discussed earlier, many asset-based carriers may broker freight to unvetted or lower-quality carriers, which can significantly increase risk for the shipper.

- Shippers may believe that asset-based carriers offer more consistent service in terms of transit times, delivery schedules, and overall performance, particularly for ongoing and high-demand shipments.

- 3PLs are held to the same, and often stricter, KPIs as asset-based carriers, including metrics such as tender acceptance and on-time, in-full (OTIF) performance.

- In transportation, unexpected events like breakdowns and accidents can occur. When they do, 3PLs are prepared to respond swiftly and efficiently, with 24/7, year-round support from logistics experts and access to backup capacity, ensuring minimal disruption and improved overall service.

- Asset-based carriers are directly responsible for the condition and safety of the goods being transported.

- Shippers might prefer this sense of accountability, especially when dealing with valuable or time-sensitive shipments.

- While 3PLs transfer the responsibility for freight to the contracted carrier during transit, they remain fully accountable for ensuring client satisfaction.

- They also offer specialized services for time-sensitive or high-value shipments, such as expedited shipping, team drivers, and premium capacity—options that many asset-based carriers may not provide.

- Best of all, shippers can access these services seamlessly through their 3PL account manager, without the need to coordinate with additional vendors.

- Shippers may find that asset-based carriers offer more predictable pricing compared to brokers, who may fluctuate rates based on market conditions.

- This can be appealing for long-term contracts, where cost stability is a key factor.

- Despite the misconception that asset-based carriers maintain lower rates when market conditions shift, they adjust pricing to align with their business needs.

- Like asset-based carriers, 3PLs can offer long-term pricing contracts. However, 3PLs often provide additional value through greater flexibility, extensive network access, and specialized services that asset-based carriers may not offer.

- Asset-based carriers may offer specialized equipment or services (i.e., temperature-controlled trucks, flatbeds, or oversized loads) that are tailored to the shipper’s specific needs.

- 3PLs offer access to a wide range of specialized equipment and multi-modal solutions that many individual asset-based carriers cannot provide.

- An asset-based carrier’s capacity is limited by their equipment. The more specialized the equipment, the lower the total market capacity, and higher the demand.

- If your asset-based carrier’s equipment is fully booked, a 3PL is your best option to secure the capacity you need – when and where you need it.

- Larger asset-based carriers have an established network and infrastructure, which can offer greater capacity for managing peak seasons, surges in demand, or specific logistical needs.

- Even the largest asset-based carrier cannot match the expansive capacity network of a 3PL.

- Returning to the core theme of this article, 3PLs provide access to a broad network of highly vetted carriers, offering the flexibility needed during peak seasons and ensuring reliable service across all lanes.

Challenges with Using

Asset-Based Carriers

While the benefits outlined above make asset-based carriers attractive to some shippers, there are also drawbacks. For example, asset-based carriers can face capacity limitations based on their available equipment, and they may not always be able to handle fluctuating or unexpected freight volumes as flexibly as brokers or 3PLs. This can lead to freight being brokered to unvetted carriers.

As such, while many shippers prefer asset-based carriers for the reasons above, brokers and 3PLs provide greater flexibility, scalability, and network diversity, which can be especially valuable for high-volume lanes or rapidly changing market conditions.

To discover how TRAFFIX can optimize your supply chain, contact us today!